Research Summary

The report discusses bullish breakouts, strong turn-of-year and presidential cycle seasonality, a zero returning China, a bearish consensus in Ags, and a dirt cheap fertilizer stock to play for a rebound. It also highlights the bullish breakout on the SPX, the bullish signal from Wayne Whaley’s TOY Barometer, and the neutral reading from BofA’s Bull & Bear.

Key Takeaways

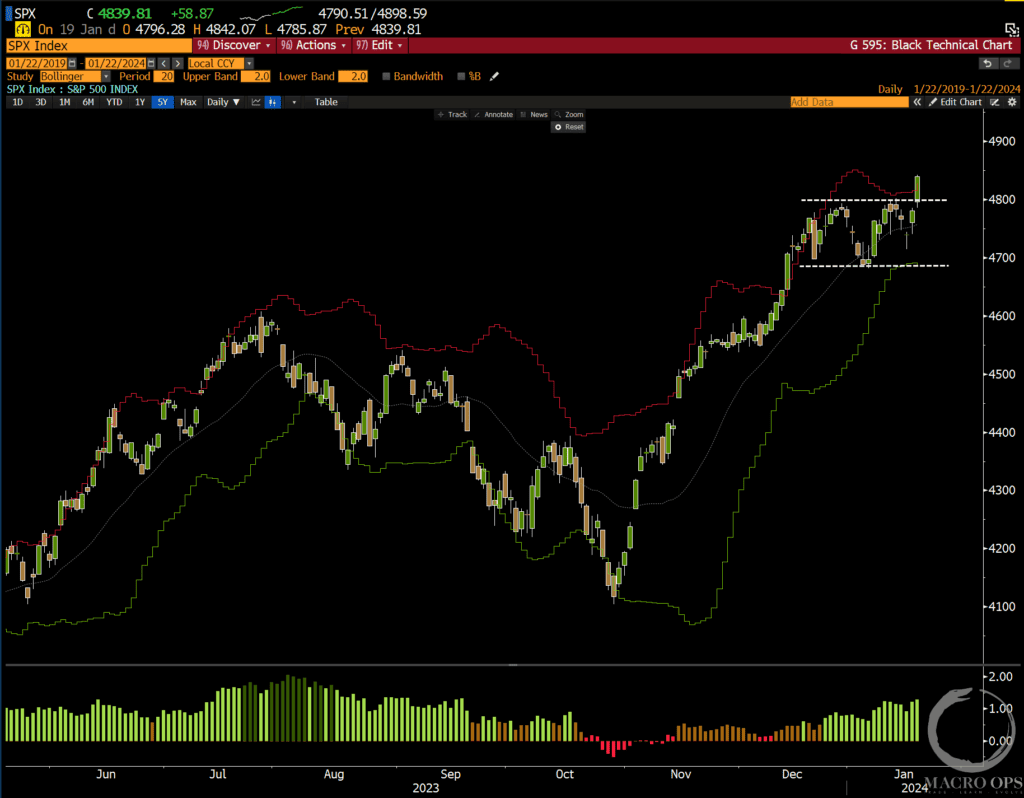

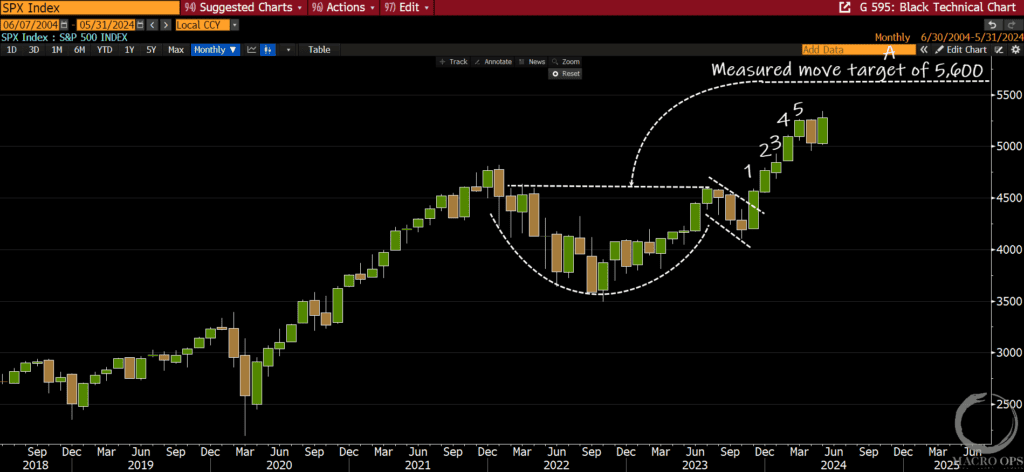

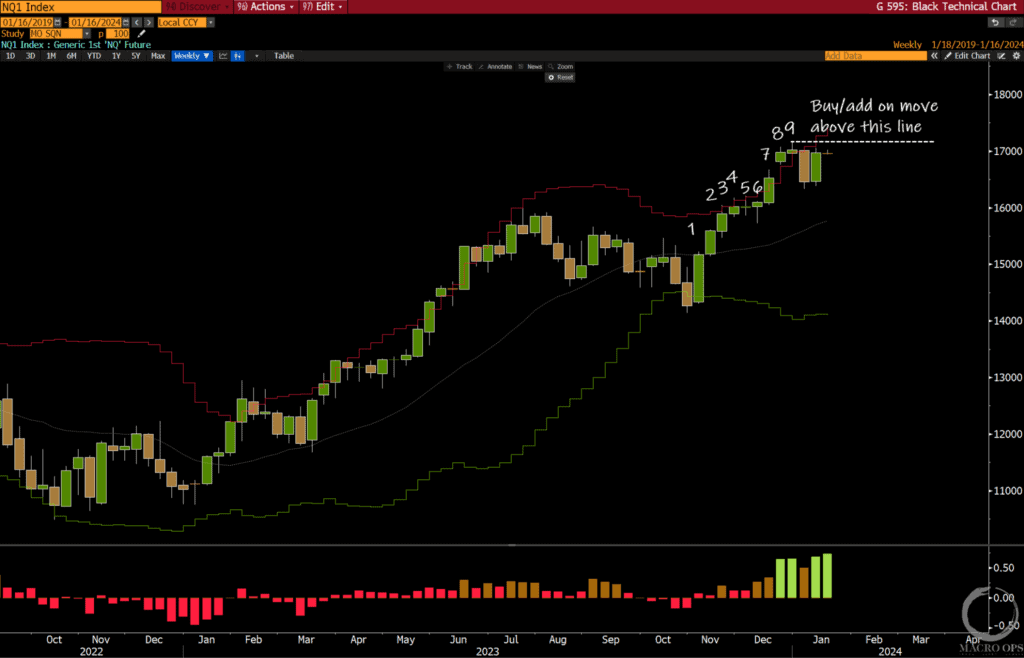

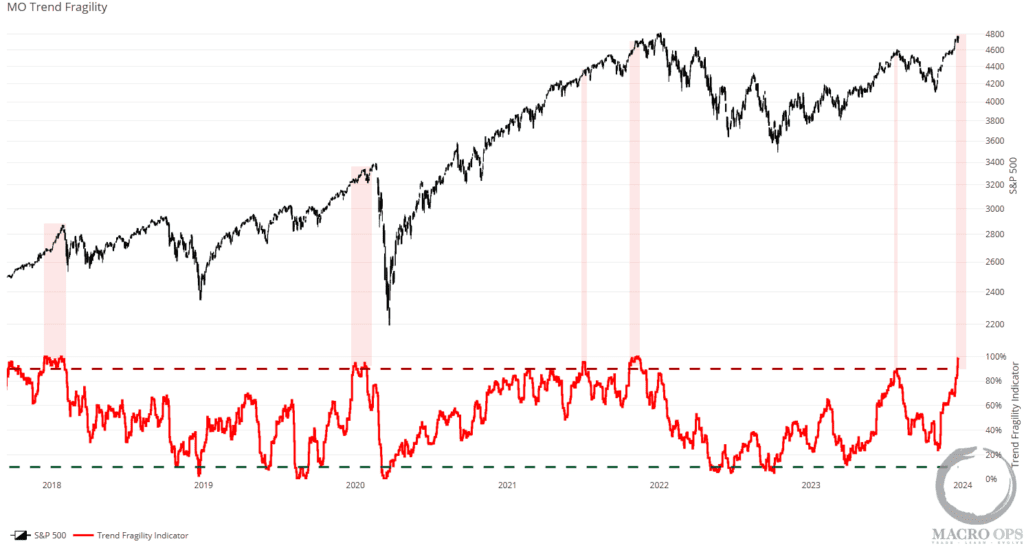

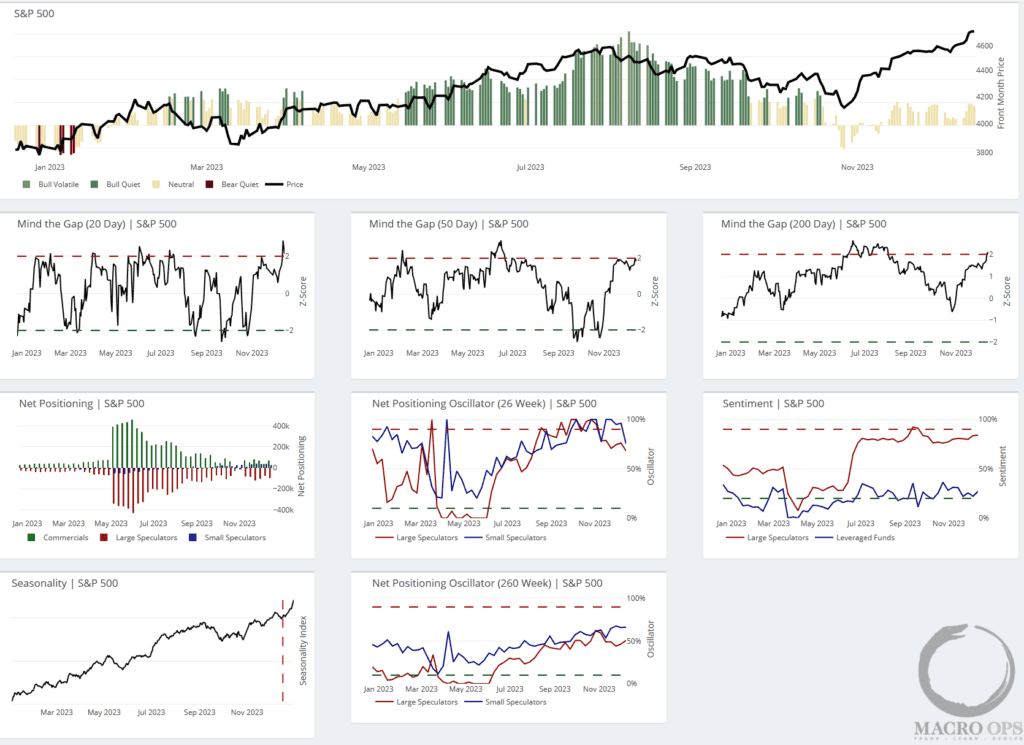

Bullish Breakout on SPX

- SPX Trading in Bull Quiet Regime: The report notes a bullish breakout on the SPX, which is currently trading in a Bull Quiet regime. This is supported by confirming market internals, a supportive liquidity backdrop, and an increasingly parabolic trend. The current odds favor an acceleration to the upside.

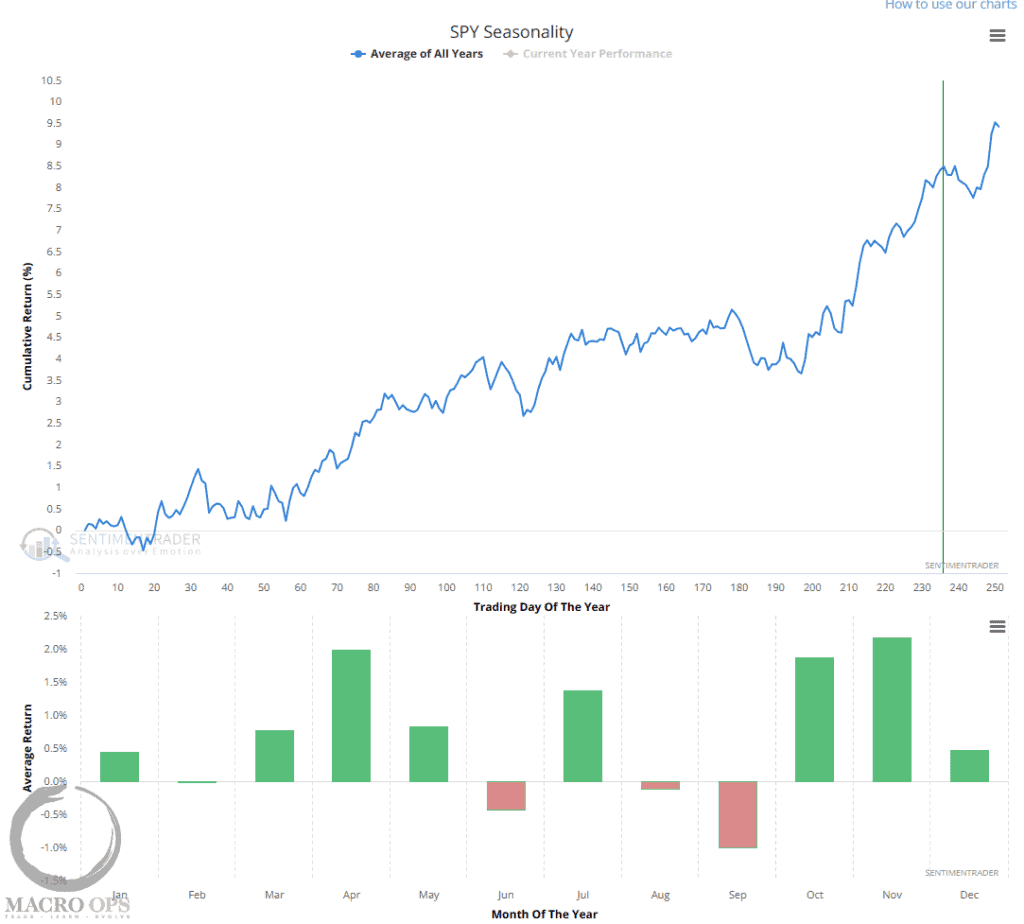

Wayne Whaley’s TOY Barometer

- Bullish Signal: Wayne Whaley’s TOY (Turn Of Year) Barometer fired a bullish signal this past week. A bullish TOY signal has a very high win rate, indicating a positive trend direction for the year.

BofA’s Bull & Bear Indicator

- Neutral Reading: BofA’s Bull & Bear, a longer-term measure of sentiment and positioning, is currently giving a neutral reading. This suggests that there is still sentiment fuel to drive the market higher.

Presidential Cycle Year

- Positive Outlook: The report notes that this is an election year where markets tend to perform well. BofA points out that when Presidential Cycle Year 3 is up 20% or more, Year 4 is up 100% of the time on an average return of 13.4% (12.6% median), which equates to SPX 5,400.

UK Housing Crisis

- Homebuilding Sector: The UK is facing a housing crisis due to decades of political red tape and NIMBY’ism that have stunted the country’s homebuilding sector. The country needs more homes, and those that build them should do well.

Actionable Insights

- Monitor SPX Trends: Given the bullish breakout on the SPX, it would be prudent to closely monitor the market internals and liquidity backdrop to anticipate potential accelerations to the upside.

- Consider TOY Barometer Signals: The bullish signal from Wayne Whaley’s TOY Barometer suggests a positive trend direction for the year. This could be a useful indicator for assessing market trends.

- Assess Sentiment and Positioning: The neutral reading from BofA’s Bull & Bear indicates that there is still sentiment fuel to drive the market higher. This could be a key factor to consider when evaluating market dynamics.

- Consider Election Year Trends: The positive outlook for the Presidential Cycle Year could have significant implications for market performance. This trend should be taken into account when making market predictions.

- Research the UK Homebuilding Sector: The UK’s housing crisis presents potential opportunities in the homebuilding sector. Researching companies in this sector could provide valuable insights.