Research Summary

The report identifies five undervalued altcoins that are predicted to surge in 2024. These include Thales ($THALES), GameSwift ($GSWIFT), XPerp ($XPERP), Mux Protocol ($MCB), and Website AI ($WEBAI). The report provides an in-depth analysis of each altcoin, highlighting their unique features, current market capitalization, and potential growth catalysts.

Key Takeaways

Thales: Betting on Custom Markets

- Thales’ Consistent Development: Thales ($THALES) is a gambling layer that allows other projects to build custom markets on top of it. The project has been consistently developing and adding more products throughout the year, including a metaverse game and a sports betting platform.

- Volume and Fee Capture: With the implementation of account abstraction and more markets, Thales’ Overtime platform is expected to capture more volume and fees, benefiting $THALES.

GameSwift: Gaming Infrastructure and Platform

- GameSwift’s Key Infrastructures: GameSwift ($GSWIFT) is a gaming platform that houses four key infrastructures: a chain, Web3 infrastructure, platform, and gaming studio. It is the first gaming infrastructure on Arbitrum.

- Undervalued Market Capitalization: Despite its top-quality games and the potential of its gaming SDK, GameSwift is still undervalued with a market capitalization of $26 million. The report suggests that it could easily 10x more, with its next best competitor being $MAGIC at $220 million market capitalization.

XPerp: Leveraged Trading for Long-Tail Assets

- XPerp’s Expansion: XPerp ($XPERP) started with trading perpetuals for friendtech keys and then expanded to other long-tail assets for leveraged trading. It has a user-friendly interface on Telegram.

- Undervalued Market Capitalization: Despite being in development since October 2023, XPerp is still undervalued with a market capitalization of $1.5 million.

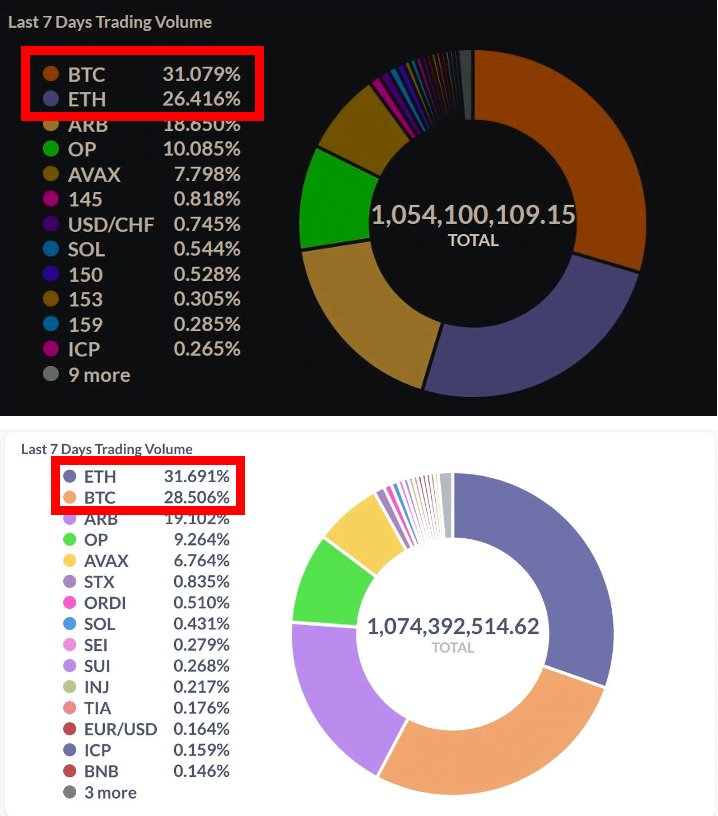

Mux Protocol: The 1inch for Perpetual DEXes

- Mux Protocol’s Trading Volume: Mux Protocol ($MCB) is likened to 1inch for perpetual DEXes. In just seven days, it handled a trade volume of approximately $1.5 billion and generated $250,000 in fees in just 24 hours.

- Increasing Demand for Tokens: Mux Protocol is working on a wrapper for veMUX to get liquid, which will increase the locking rate and demand for tokens. They are also increasing the leverage on $GMX, boosting it up to 100x, and with their POL, risks are isolated.

Website AI: AI-Powered Website Creation

- Website AI’s User Base: Website AI ($WEBAI) allows anyone to create a website without coding, with the help of AI. It has over 5,000 users and has generated 460 websites.

- Undervalued Market Capitalization: Despite its working utility, revenue share, and strong community, Website AI is still undervalued with a market capitalization of $2.5 million. The report suggests that it could catch good wind along with the AI wave.

Actionable Insights

- Monitor Thales’ Development: Keep an eye on Thales’ consistent development and the potential increase in volume and fees from its Overtime platform.

- Assess GameSwift’s Potential: Evaluate GameSwift’s potential for growth given its key infrastructures and undervalued market capitalization.

- Track XPerp’s Expansion: Follow XPerp’s expansion into other long-tail assets for leveraged trading and its potential for growth.

- Observe Mux Protocol’s Trading Volume: Monitor Mux Protocol’s trading volume and the potential increase in demand for its tokens.

- Watch Website AI’s Growth: Keep an eye on Website AI’s user base growth and its potential to catch the AI wave.