Research Summary

The report discusses the top five farms of the week, including MUX Protocol, HMX, Kyber Network, Timeswap, and Camelot. Each farm is analyzed based on its unique features, yield rates, and the types of tokens involved.

Key Takeaways

MUX Protocol: A Stable Source of Yield

- Stability and Diversity: MUX Protocol, a perpetual exchange and aggregator, has proven to be a stable source of yield. The yield-bearing index includes 50% stables, 28% ETH, 14% BTC, and 8% Alts.

- Attractive Returns: Investors can earn a 36% APR paid in ETH and MUX tokens.

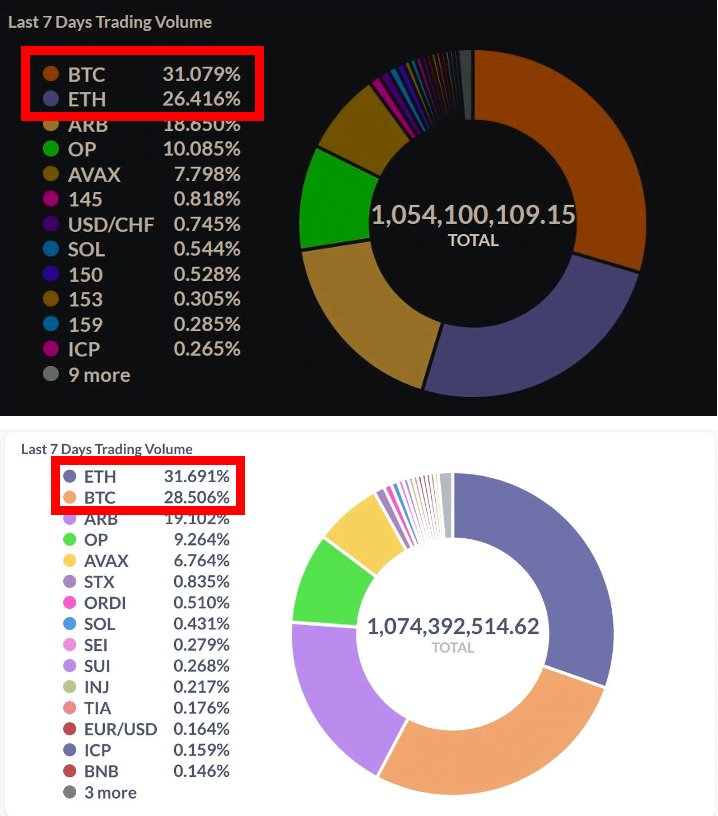

HMX: A Perpetual Exchange with High TVL

- Wide Range of Assets: HMX is a perpetual exchange on Arbitrum for crypto, forex, equities, and more. It has managed to attract a significant amount of Total Value Locked (TVL) and volume.

- High Yield: HLP, a GLP-style liquidity pool, is currently yielding around 45% APY, which is mostly made up of real yield from fees.

Kyber Network: A Cross-Chain DEX with Lucrative Farms

- Multi-Chain Farming: KyberSwap, a cross-chain DEX and aggregator, is currently on 14 chains. It offers numerous lucrative farms, allowing farming on almost any chain.

- High APRs: Some of the best yields include LINK/USDC @ 227% APR, OP/USDC @ 189% APR, ARB/USDC @ 246% APR, and wstETH/USDC @ 83% APR.

Timeswap: The Uniswap of Lending and Borrowing

- Innovative Approach: Timeswap leverages time-based isolated liquidity pools to allow for a zero-liquidation, oracle-free, and completely decentralized money market.

- Lucrative Pre-Mining Program: The pre-mining program offers 48% APR on wMNT/USDC, 37% APR on ARB/USDC, and 52% APR on ETH/USDT.

Camelot: A Community-Led DEX in the Arbitrum Ecosystem

- Community Focus: Camelot is a community-led and capital-efficient DEX in the Arbitrum ecosystem. Users can trade, provide liquidity, and participate in token sales via the launchpad.

- High Yields: Some of the most lucrative yields currently available include ARB/USDC @ 152% APR, ETH/USDC @ 120% APR, and GMX/ETH @ 102% APR.

Actionable Insights

- Investigate the Potential of MUX Protocol: Given its stability and diversity of tokens, MUX Protocol could be a promising farm to consider.

- Explore HMX’s High TVL: The high Total Value Locked (TVL) and volume of HMX suggest a significant level of interest and activity, which may warrant further investigation.

- Consider the Cross-Chain Opportunities of Kyber Network: The ability to farm on almost any chain offered by Kyber Network could provide diverse opportunities for yield farming.

- Examine Timeswap’s Innovative Approach: Timeswap’s unique approach to lending and borrowing could offer a different perspective on yield farming.

- Assess the Community-Led Approach of Camelot: Camelot’s community-led approach and high yields could make it an interesting farm to explore.