Research Summary

The report provides an analysis of the latest monthly charts, focusing on the SPX, silver, USD pairs, and coffee. It also discusses the potential for a new bull market in precious metals, the possibility of a rally in USD pairs, and the prospect of a short in coffee. The report also highlights the increasing restrictiveness of monetary policy and its potential impact on the economy.

Key Takeaways

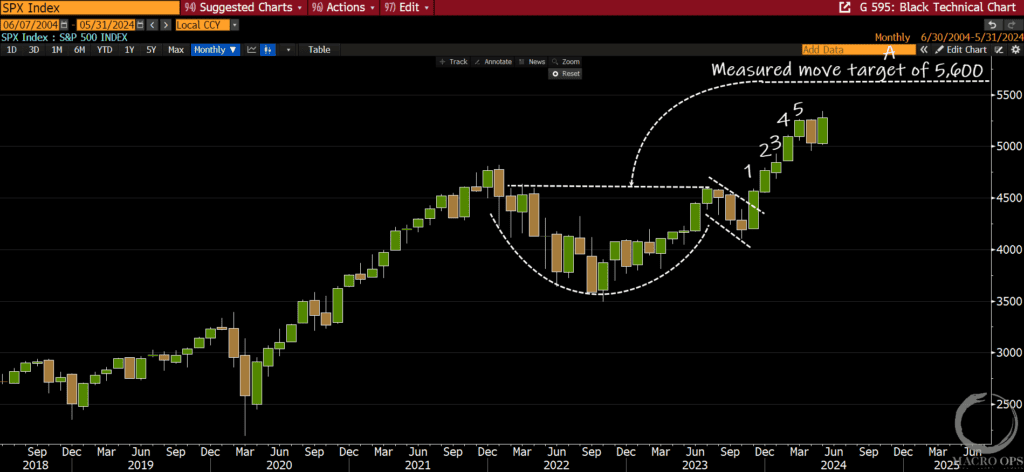

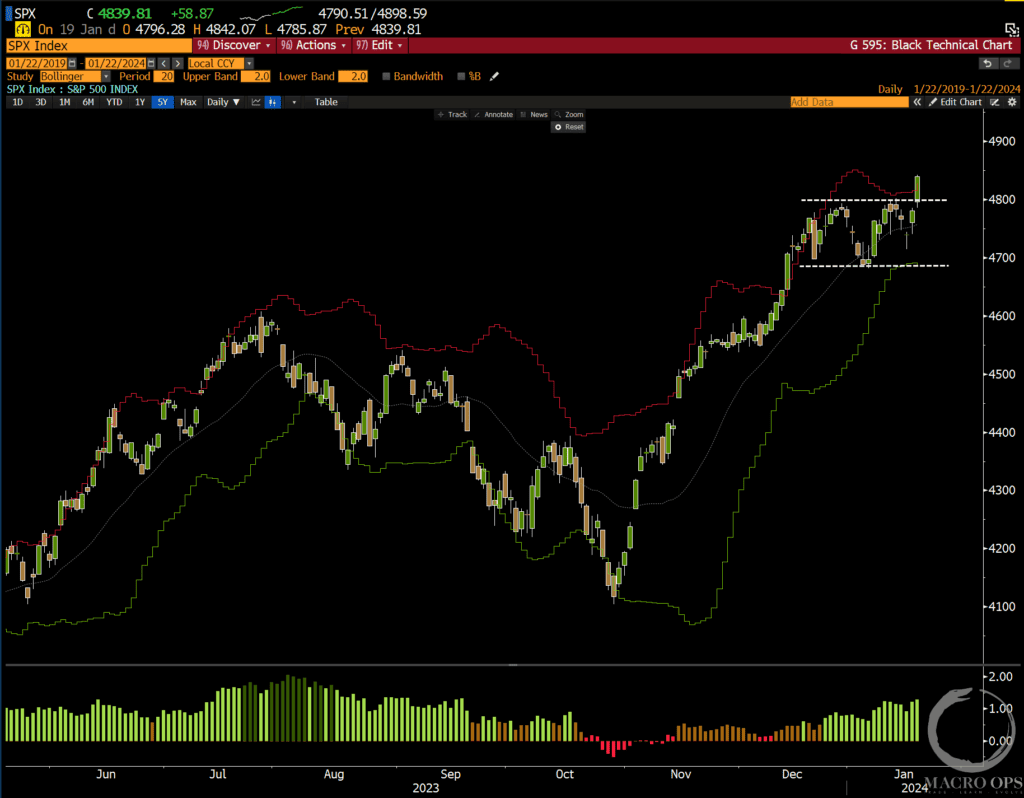

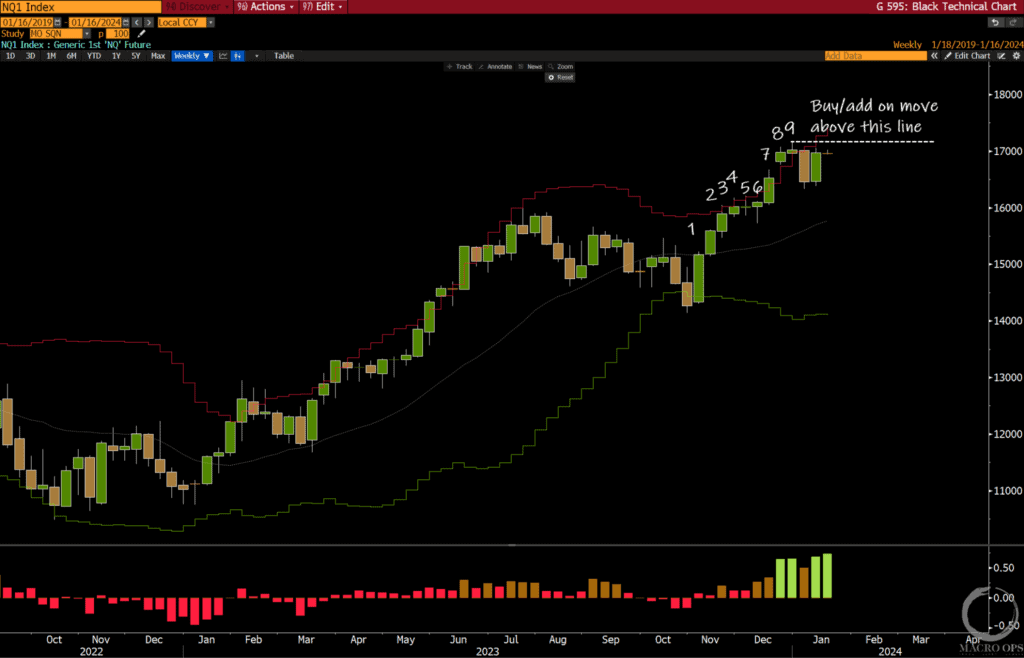

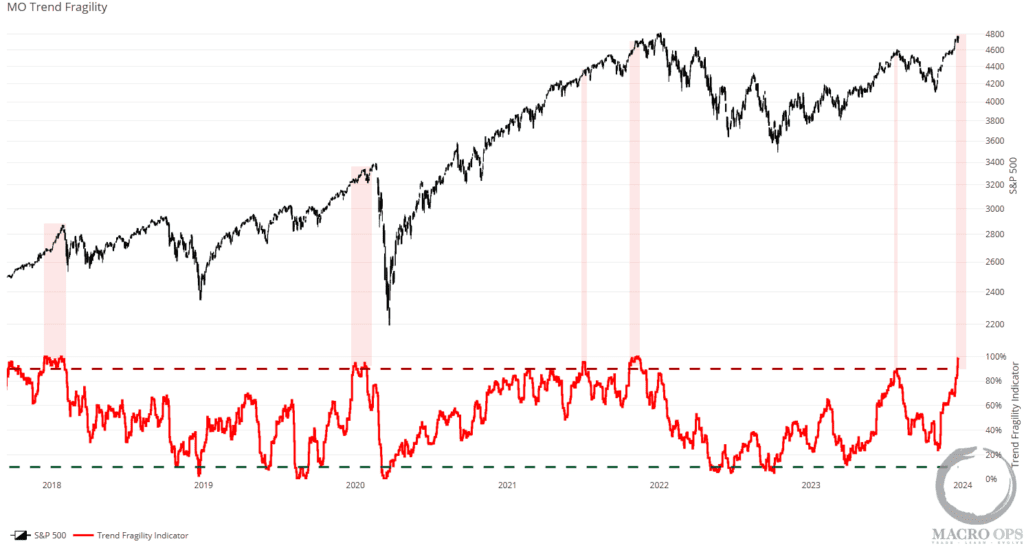

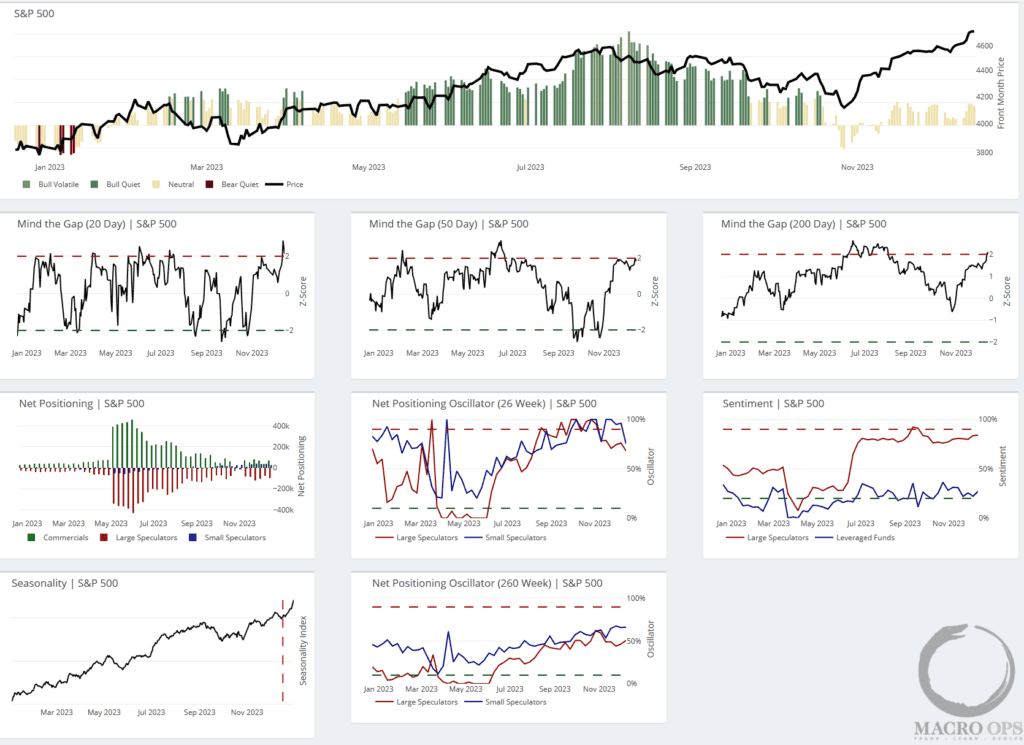

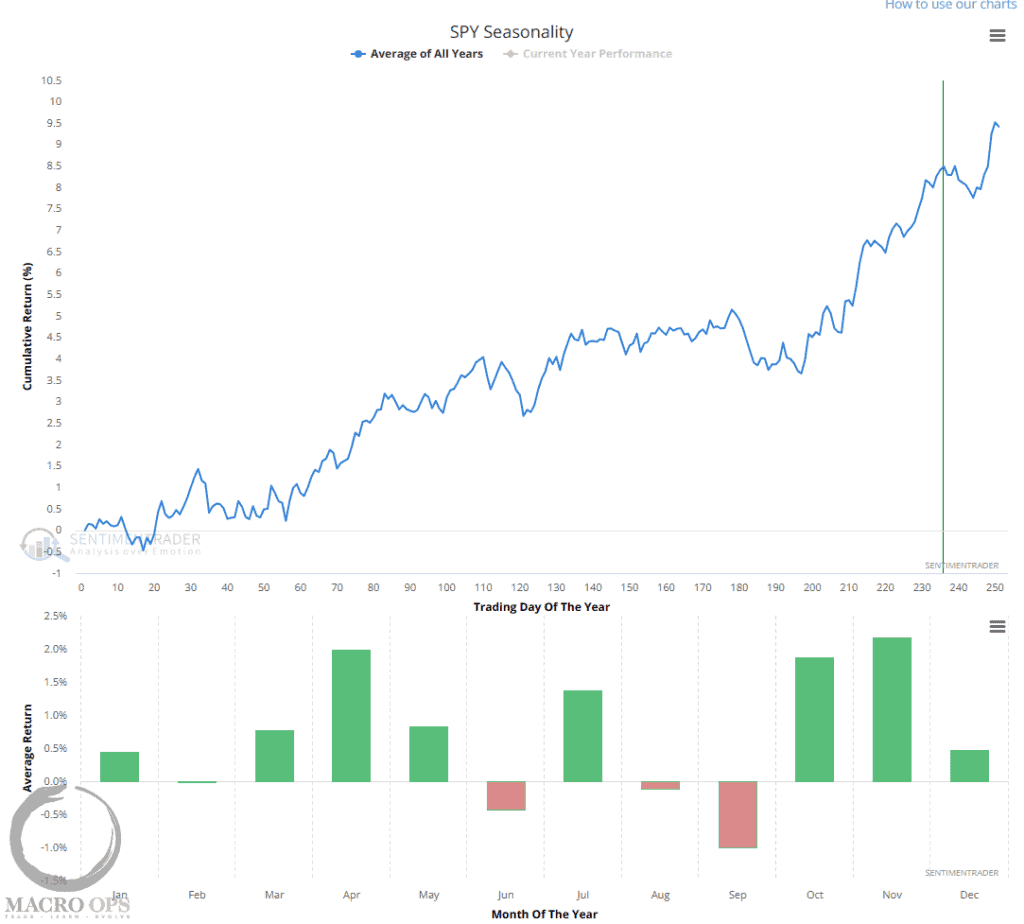

SPX’s Bullish Outlook

- SPX’s New High: The SPX has reached a new monthly closing all-time high following a strong five-month consecutive bull bar breakout from a two-year cup-n-handle pattern. The report suggests that the last month was the correction ending the first bull leg and we’re about to embark on the second one higher. The measured move target for the larger pattern is 5,600.

Silver’s Cyclical Bull Market

- Silver’s High Close: Silver saw its highest monthly close in over 21 years. Despite the possibility of more sideways chop and volatility in the near term due to short-term extension and positioning, the chart suggests a renewed cyclical bull market in precious metals.

USD Pairs’ Potential Rally

- USD Pairs’ Compression: The report notes major compression across a number of USD pairs, suggesting a big trend is coming. The trend is expected to be to the upside (USD down).

Coffee’s Short Opportunity

- Coffee’s Reversal Bar: Coffee saw a big reversal bar at its upper band, giving a double top on the weekly. With sentiment and positioning both stretched long, this provides a good opportunity to take a swing short.

Increasingly Restrictive Monetary Policy

- Monetary Policy’s Impact: The report notes that monetary policy is becoming increasingly restrictive. This isn’t showing up in current financial conditions yet, but it will later in the year unless the Fed starts pushing cuts again. The chart shows real GDP YoY% (orange line) and real Fed Funds (white line), indicating that when Fed Funds cross above real GDP, bad things tend to soon follow.

Actionable Insights

- Monitor SPX’s Progress: Given the bullish outlook for SPX, it would be beneficial to keep a close eye on its progress and the potential for the second bull leg.

- Research Silver’s Market: With the potential for a renewed cyclical bull market in precious metals, it would be worthwhile to research this market further.

- Track USD Pairs: Given the major compression across a number of USD pairs, tracking these pairs could provide insight into potential trends.

- Consider Coffee’s Positioning: With the potential for a swing short in coffee, considering its positioning and sentiment could provide valuable insights.

- Assess Monetary Policy’s Impact: With monetary policy becoming increasingly restrictive, assessing its potential impact on the economy could provide valuable insights for future financial decisions.