Research Summary

The report discusses five yield farming platforms, namely Radpie, Florence Finance, MUX Protocol, Stella, and Trader Joe. These platforms offer various opportunities for users to earn attractive yields on their blue-chip tokens, with APRs ranging from 7% to over 1400%.

Key Takeaways

Radpie: Liquid Locker and Yield Booster

- Attractive Yields: Radpie, built on Radiant, offers users the opportunity to convert their DLP to mDLP for liquidity and extra rewards in RDP tokens. The platform offers attractive yields, with APRs of 70% on mDLP, 50% on BNB, 31% on USDC, and 29% on USDT.

Florence Finance: Euro-based RWA Protocol

- Stablecoin Lending: Florence Finance allows users to lend their stablecoins for yields backed by real-world borrowers in Europe. Depositors can earn 7-10% APR on their stablecoins and qualify for an upcoming airdrop. The platform’s TVL is still relatively low, indicating potential for higher airdrop rewards.

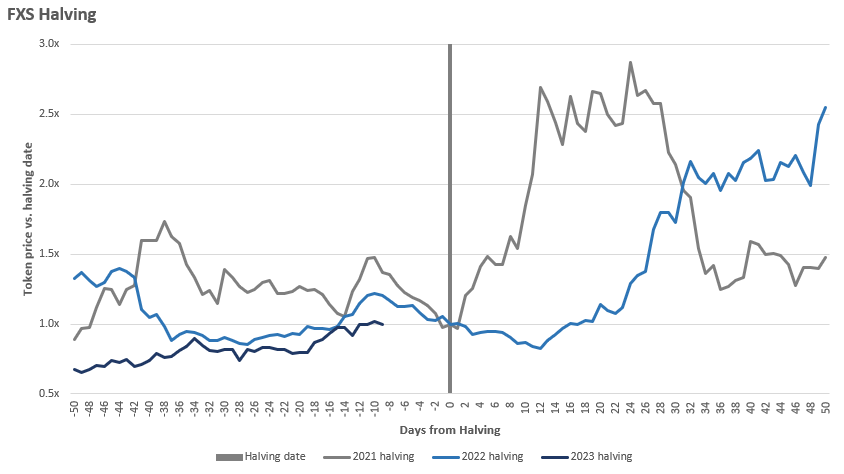

MUX Protocol: Perpetual Exchange and Aggregator

- Stable Yield Source: MUX Protocol has proven to be a stable source of yield over the past months. Users purchasing MUXLP buy into a yield-bearing index of blue-chip tokens, earning a 39% APR paid in ETH and MUX tokens.

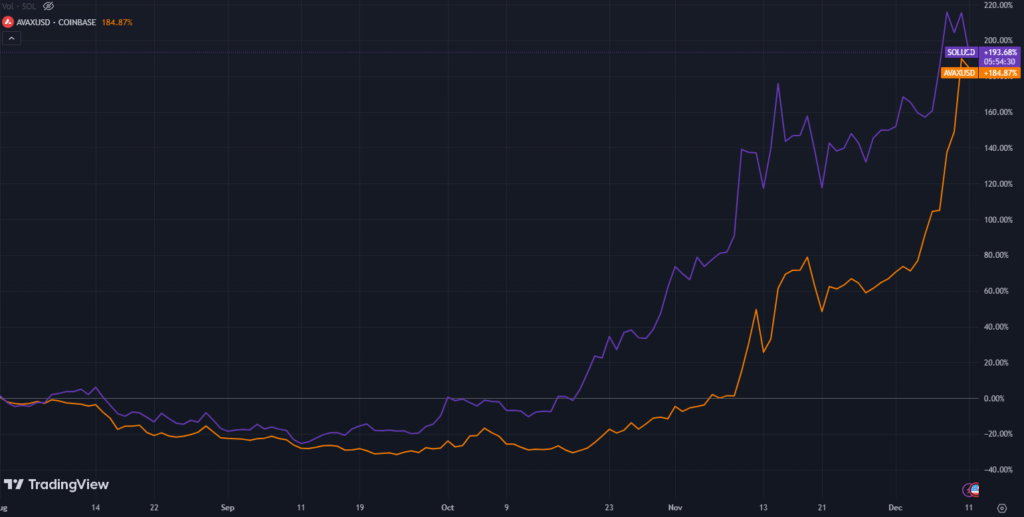

Stella: Leveraged Yield Farming Protocol

- Leveraged Farming: Stella allows users to lend their tokens for double-digit APRs or farm blue-chip pairs with up to 5-10x leverage. The platform offers lucrative yields, with APRs of up to 1413% on ARB/USDC, 1336% on PENDLE/ETH, 85% on wstETH, and 21% on USDC.

Trader Joe: Hyper-efficient AMM

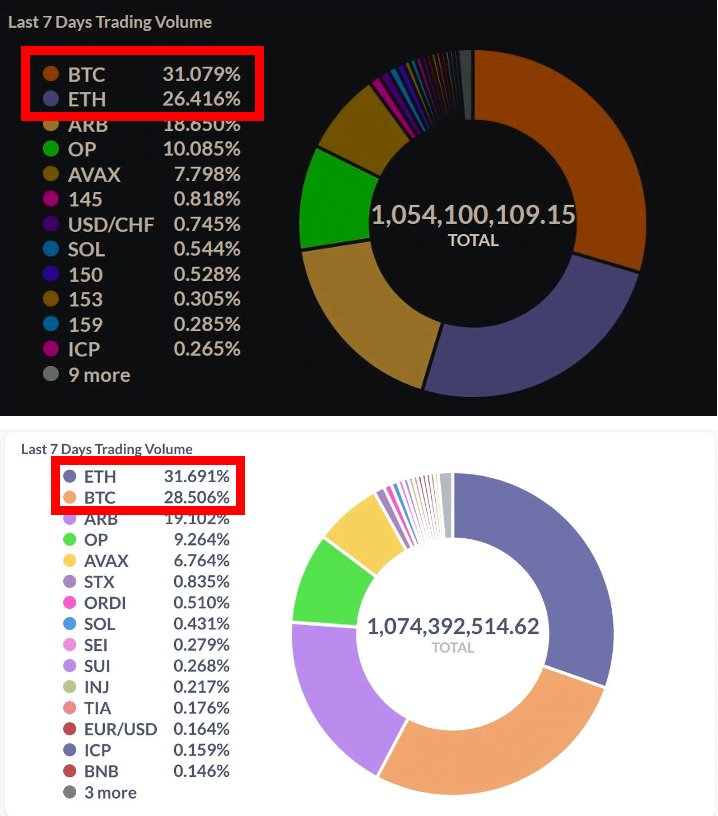

- High Trading Volume: Trader Joe, an AMM on Avalanche, Arbitrum, and BNB, offers high trading volume and plenty of ARB token incentives. The platform’s pools offer APRs of 460% on ARB/USDC, 230% on PENDLE/ETH, 191% on RDNT/ETH, and 91% on AVAX/USDC.

Actionable Insights

- Explore Yield Farming Opportunities: Investors may want to explore the yield farming opportunities offered by these platforms, considering their attractive APRs and potential for additional rewards.

- Consider Stablecoin Lending: Stablecoin lending on platforms like Florence Finance could be a viable strategy for earning yields backed by real-world borrowers.

- Research Leveraged Farming: Leveraged farming on platforms like Stella could offer higher returns, but investors should be aware of the associated risks.

- Monitor Trading Volume: High trading volume on platforms like Trader Joe could indicate strong market activity and potential yield farming opportunities.