Podcast Summary

This podcast episode features an in-depth discussion with macro investor Felix Zulauf. Zulauf shares his insights on the current state of the liquidity cycle, bond market, stock market, and the broader economy. He also discusses the potential risks and opportunities in the U.S., China, and Japan’s financial markets. Zulauf expresses skepticism about the continued rise in asset prices and warns of potential geopolitical risks that could drive commodity prices higher.

Key Takeaways

State of the Liquidity Cycle

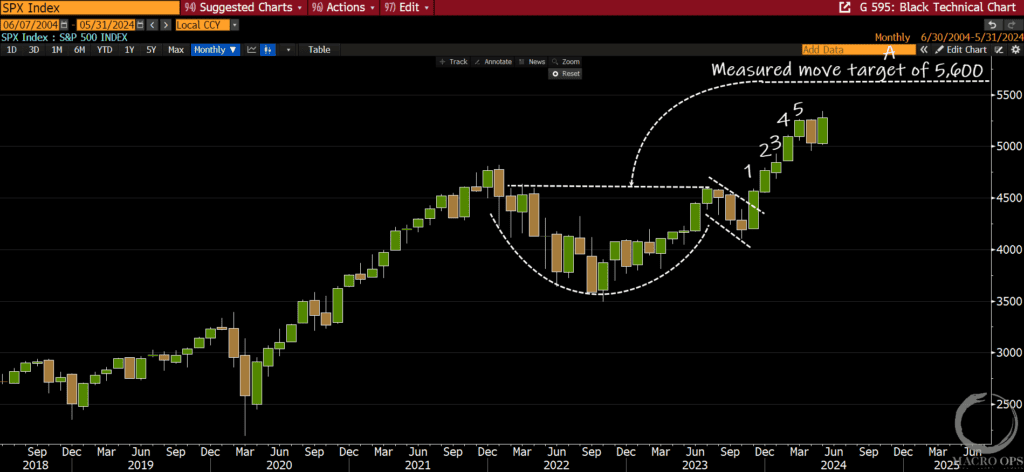

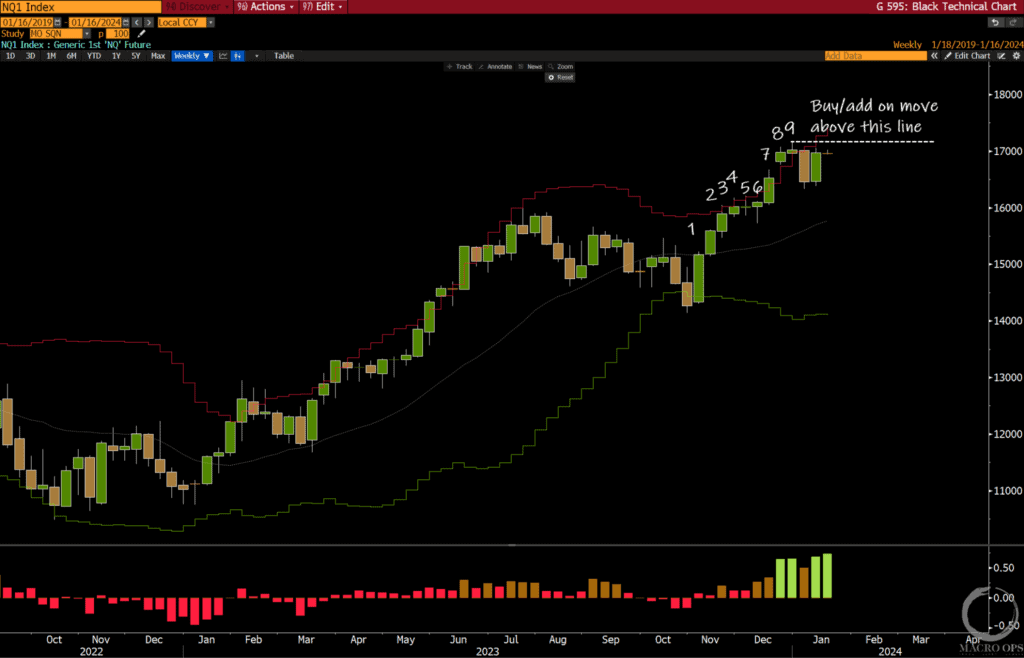

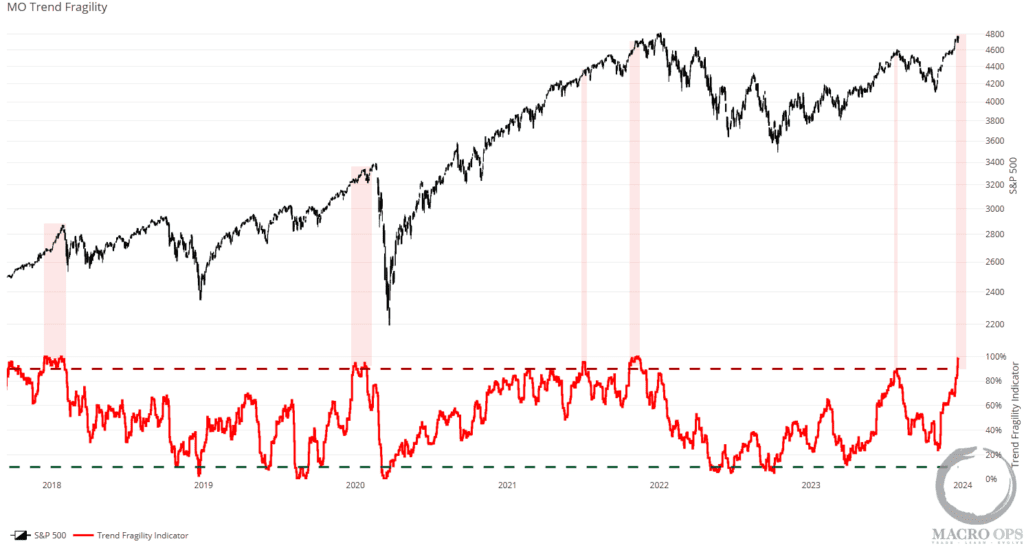

- Liquidity Cycle Downturn: Zulauf notes that the liquidity cycle began its downturn in late 2021, with the stock market bottoming in late 2022. He anticipates a potential end to the liquidity cycle in early 2024.

- Bullishness in the Bond Market: Zulauf highlights the extreme bullishness in the bond market, with a Bank of America global fund survey showing 54% of managers favoring bonds as the best asset class for the next 12 months.

- Consensus for Declining Bond Yields: There is a strong consensus for declining bond yields, with 70% expecting a drop. However, Zulauf warns that when consensus is strong, outcomes often differ from expectations.

Geopolitical Risks and Commodity Prices

- Geopolitical Risks: Zulauf discusses the geopolitical risks that could drive commodity prices higher, such as conflicts between rival powers and potential supply cuts by BRICS countries.

- Potential Increase in Oil Prices: He also mentions the possibility of a significant increase in oil prices if geopolitical tensions escalate, particularly if Iran becomes involved in a conflict and closes the Strait of Hormuz.

State of the U.S. Stock Market

- Overpriced U.S. Stocks: The podcast guest expresses the view that U.S. stocks are overpriced, particularly the leading stocks, which he refers to as the “magnificent 7.”

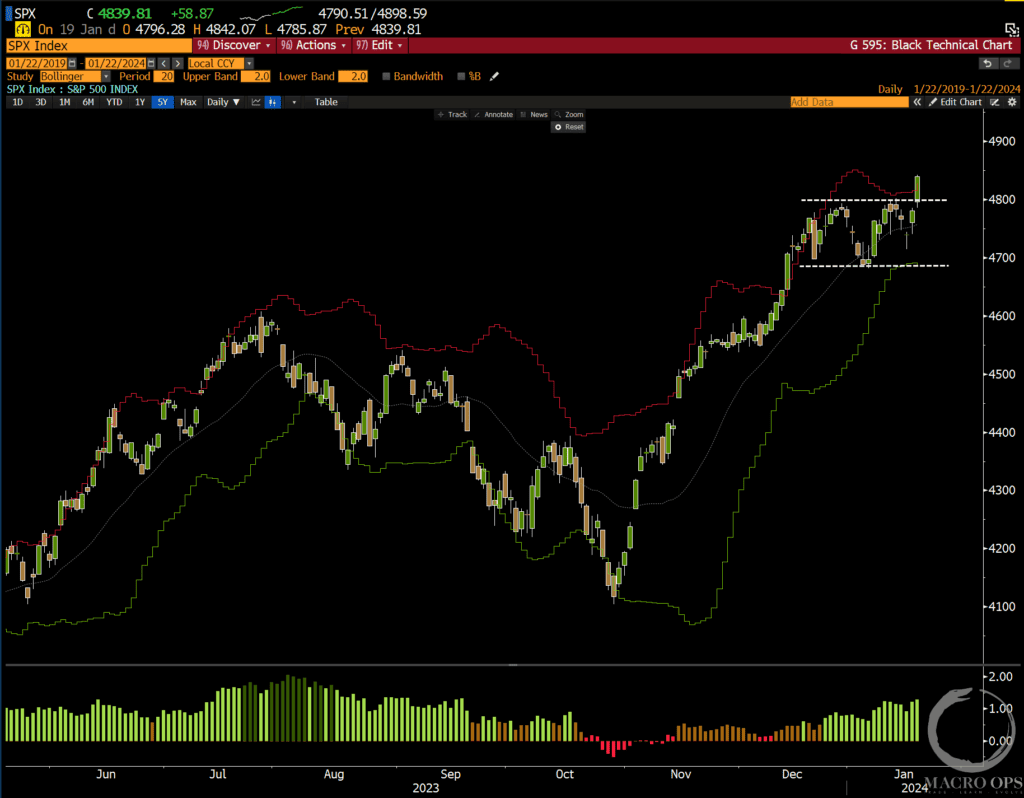

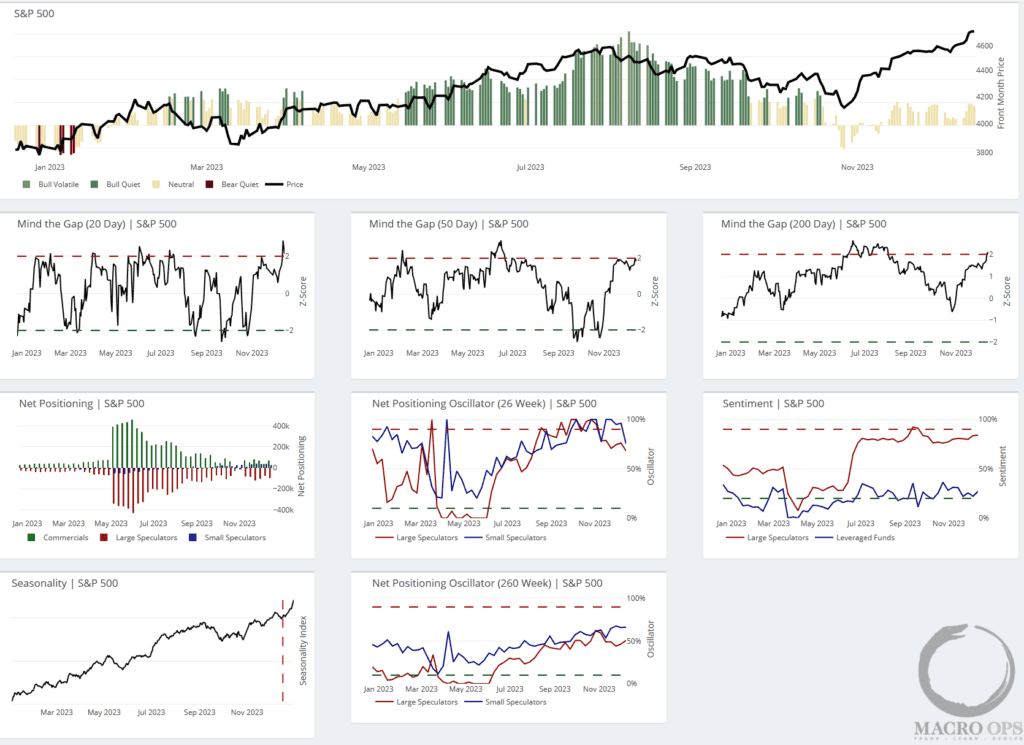

- Potential Correction in the S&P 500: The guest predicts a potential correction in the S&P 500, which could drop to around 4,300, followed by a rally up to 4,900.

- Concentration of Investments: The guest highlights the concentration of investments in the U.S. market, with 62% of all world index products invested in the U.S. and 30% of that money going into just seven stocks.

China’s Economic Challenges

- China’s Real Estate Problem: Felix explains that China is grappling with a real estate problem and production overhang, which he predicts will take at least a decade to resolve.

- China as a Restraining Factor: Felix asserts that China, which was once a driving force in the global economy, will now act as a restraining factor.

- China’s Strategy: He also mentions China’s strategy to run large current account surpluses and its preparation for potential conflict with the U.S., including building strategic reserves and fostering nationalism.

Japan’s Economic Performance

- Japan’s Stock Market Performance: Felix comments on the strong performance of the Japanese stock market, driven by a weak yen.

- Bank of Japan’s Yield Curve Control Policy: Felix discusses the Bank of Japan’s yield curve control policy and suggests that if the policy changes, the yen could become the strongest currency globally.

- Potential Bull Move in the Japanese Yen: Felix predicts a potential bull move in the Japanese yen against other currencies but clarifies that this is contingent on a fundamental change in Japan’s monetary policy.

Sentiment Analysis

- Bullish: Zulauf expresses short-term bullishness on both stocks and bonds until the middle or end of Q1 2024. He is also bullish on the U.S. dollar despite a consensus bearish outlook.

- Bearish: Zulauf warns of potential geopolitical risks that could drive commodity prices higher and trigger a market downturn. He also expresses skepticism about the continued rise in asset prices and warns of potential risks in the U.S., China, and Japan’s financial markets.

- Neutral: While Zulauf provides a balanced view of the current state of the financial markets, he does not express a neutral sentiment in this podcast episode.