Podcast Summary

This podcast episode delves into the complexities of loss-versus-rebalancing (LVR) and liquidity provider (LP) profitability in the DeFi space. The hosts discuss the concept of expected profit versus realized profit, the sources of information for pricing liquidity, and the importance of defensive action in market making. The episode also introduces Maverick Protocol, a partner for the season, and its innovative offerings for DeFi users and builders.

Key Takeaways

Understanding LVR and LP Profitability

- Concept of LVR: LVR is a transaction cost imposed on LPs in the DeFi space, arising due to information asymmetry and the discrepancy in timing and knowledge between different venues where prices are discovered.

- Expected Profit vs Realized Profit: The hosts discuss the difference between expected profit and realized profit in relation to LVR, highlighting that many LPs may be making money in the short term but losing money in expectation.

- Importance of Information: The hosts emphasize the importance of various sources of information for pricing liquidity, including monitoring other exchanges, staying updated with news, and observing order flow.

- Learning from Order Flow: The hosts stress the importance of learning from order flow and taking defensive action if there are signs of someone knowing something that the LP doesn’t.

- Role of External Sources: LPs can also consider external sources of information, such as oracle data, to make more informed pricing decisions.

Maverick Protocol and its Offerings

- Introduction of Maverick Protocol: Maverick Protocol, a partner for the season, is introduced as an innovative platform offering a suite of tools for DeFi users and builders.

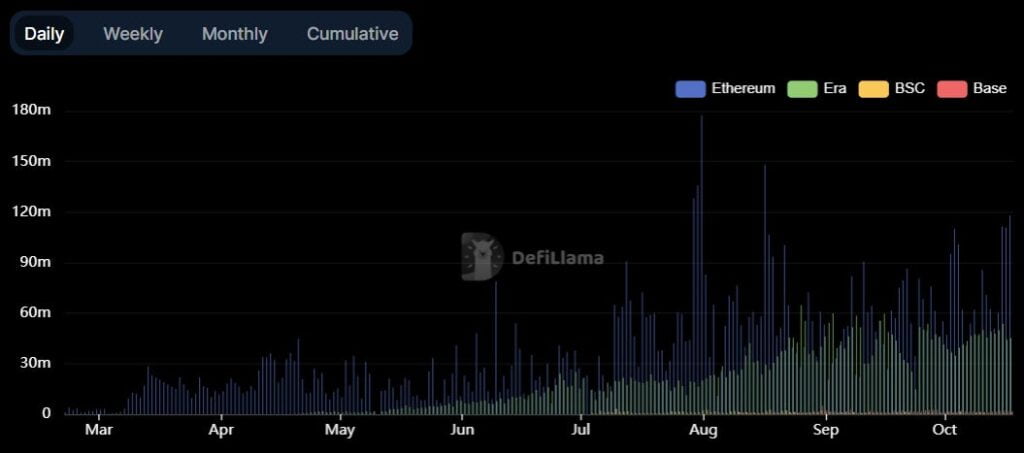

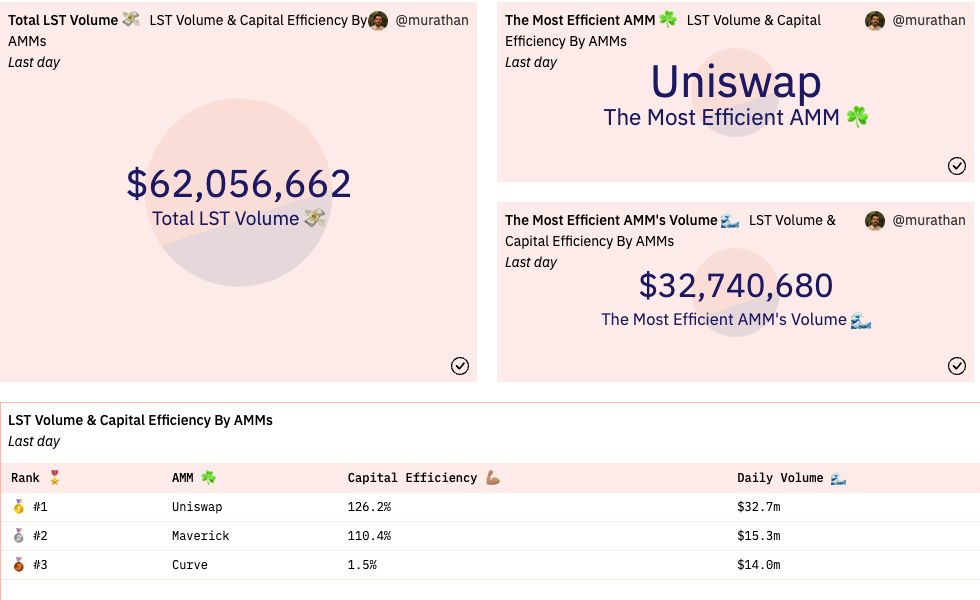

- Market Share and Volume: Maverick Protocol has gained significant market share and is now a top three DEX by volume, supporting over 50% of the volume on the L2 ZK sync chain.

- Capital Efficiency: Maverick Protocol enables higher volume processing with limited TVL, leading to high levels of capital efficiency for LPs.

- Maverick Boosted Positions: Maverick Protocol offers a feature called “Maverick boosted positions” that allows protocols to target the shape of liquidity for any token pair with precision.

Sentiment Analysis

- Bullish: The hosts express a positive sentiment towards the potential of DeFi and the innovative solutions being developed in the space, such as Maverick Protocol’s offerings. They also highlight the importance of understanding and managing LVR for LP profitability.

- Neutral: The hosts maintain a neutral stance on the complexities involved in assessing LP profitability and the challenges posed by information asymmetry and timing discrepancies in price discovery.