Research Summary

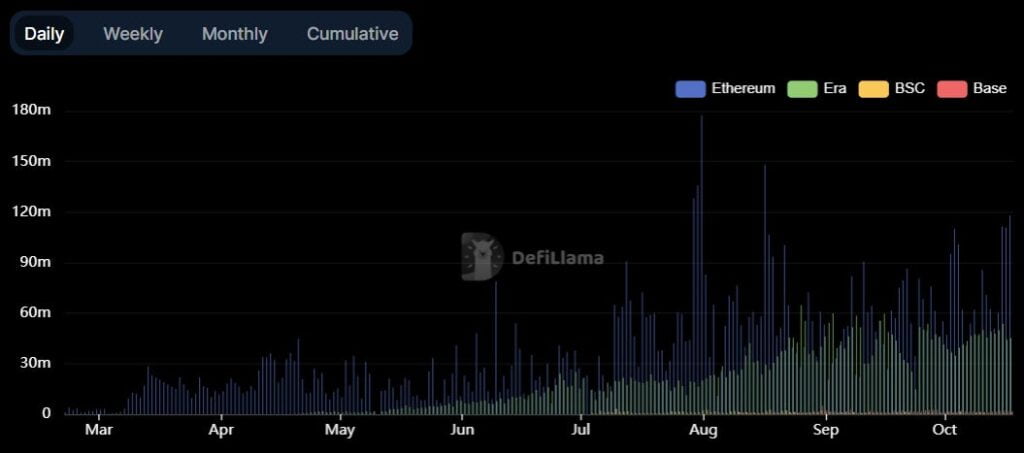

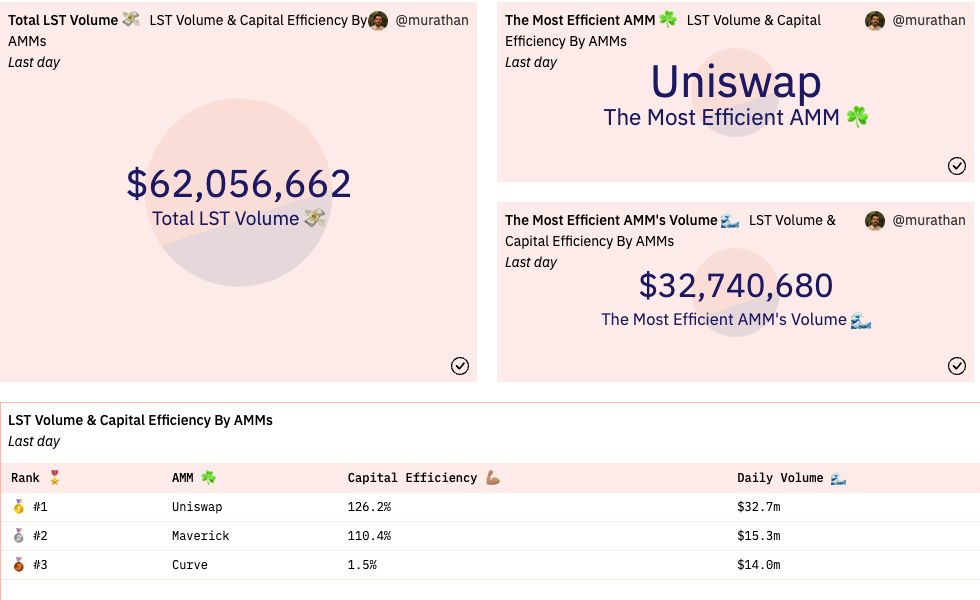

The article discusses Maverick, a decentralized exchange (DEX) that offers directional liquidity provision, extreme capital efficiency, and minimal slippage trades. Maverick’s unique features include incentivized pools, custom liquidity shaping, custom fee tiers, and directional liquidity provision through its Automated Liquidity Placement (ALP) mechanism. The DEX uses liquidity bins, discrete price ranges similar to Uniswap v3’s ticks, for its architecture. The article also highlights the potential of Liquid Staking Tokens (LSTs) to become the dominant trading pair on AMMs and possibly the dominant collateral type for options and CDPs.

Actionable Insights

- Explore Maverick’s Unique Features: Maverick offers a unique set of features including incentivized pools, custom liquidity shaping, custom fee tiers, and directional liquidity provision. Understanding these features can provide insights into the potential advantages of using Maverick over other DEXs.

- Monitor the Use of Liquidity Bins: Maverick’s use of liquidity bins is a key aspect of its architecture. Monitoring how this feature is utilized and its impact on trading could provide valuable insights into the effectiveness of this approach.

- Watch the Development of Liquid Staking Tokens (LSTs): The article suggests that LSTs could become a dominant trading pair on AMMs and possibly the dominant collateral type for options and CDPs. Keeping an eye on the development and adoption of LSTs could provide insights into future trends in the DeFi space.