Research Summary

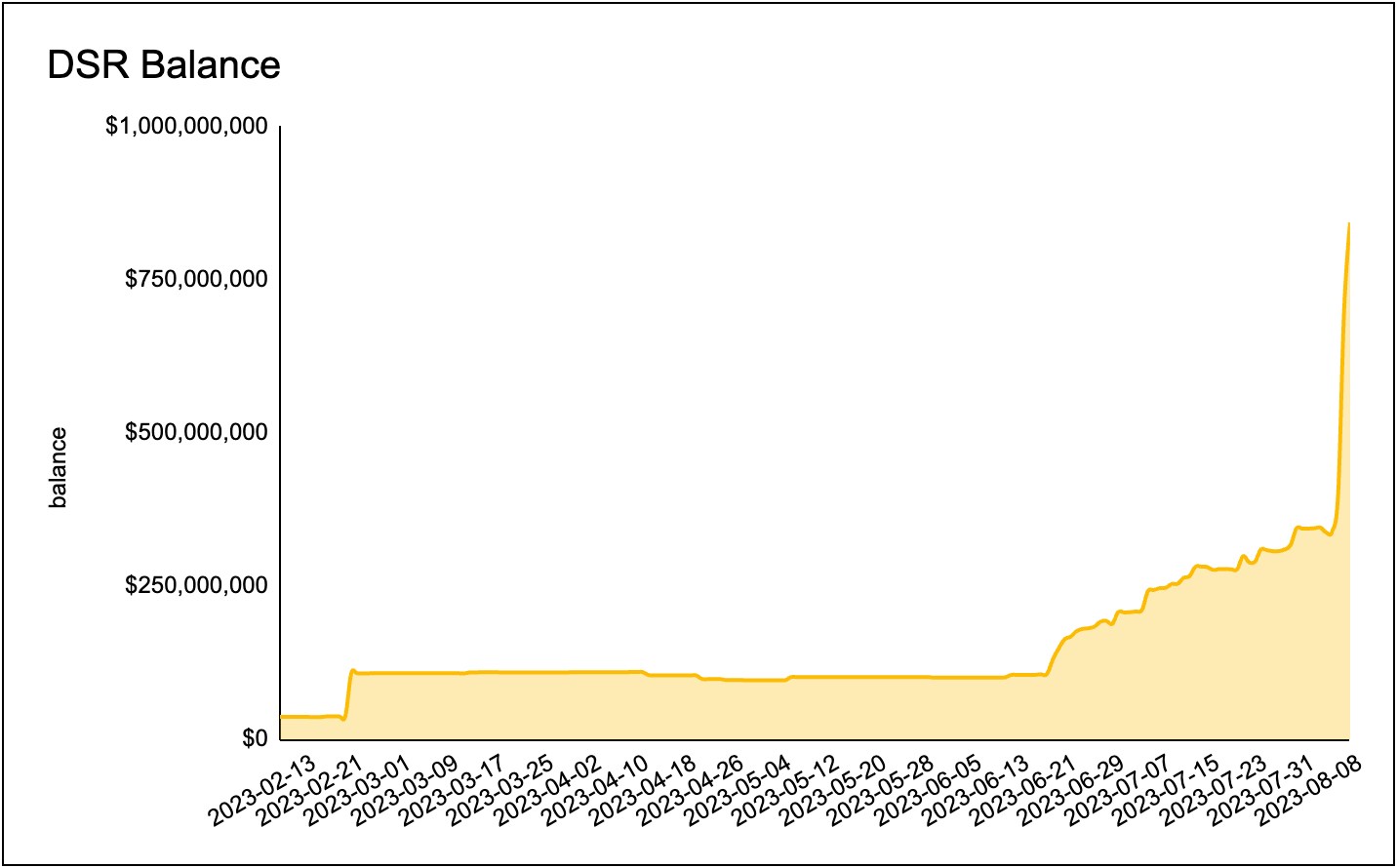

The report delves into various recent developments in the cryptocurrency domain. Key events spotlighted include the Enhanced DAI Savings Rate touching $860 million with a suggested cap set at 5% APY, the collaboration between the Mantle Ecosystem and Lido, and the initiation of Rollbit’s buy & burn initiative. The launch of PayPal’s stablecoin (PYUSD) on the Ethereum Mainnet, Chainlink’s incorporation into Coinbase’s Base L2, and SecondLane’s secondary market analysis for July 2023 are also detailed. The report concludes with data on the best-performing assets, the total value locked (TVL) across platforms, and upcoming governance proposals.

Actionable Insights

- Monitor the EDSR Yield Cap: The proposal to cap the ESDR at 5% APY may impact yield strategies.

- Explore Partnership Opportunities: The collaboration between Mantle Ecosystem and Lido indicates potential growth in ETH staking strategies.

- Assess New Stablecoin: PayPal’s launch of PYUSD on Ethereum Mainnet could influence the stablecoin market dynamics.

- Consider Investment in Top Performers: Assets such as SHIB, UNI, and MATIC are showing strong performance above $1B MC.

- Stay Informed on Governance Proposals: Proposals like activating LUSD as collateral on Aave V3 ETH pool may have implications for DeFi strategies.