Research Summary

The report discusses the current state of the market, highlighting the bullish behavior of investors, the S&P 500 volume oscillator, and the ongoing issue of inflation. It also touches on the role of the Federal Reserve, the impact of crypto Ponzi schemes, and the risks associated with the $USD/Yen carry trade. The report concludes with a warning about the potential for a market crash.

Key Takeaways

Bullish Investor Behavior

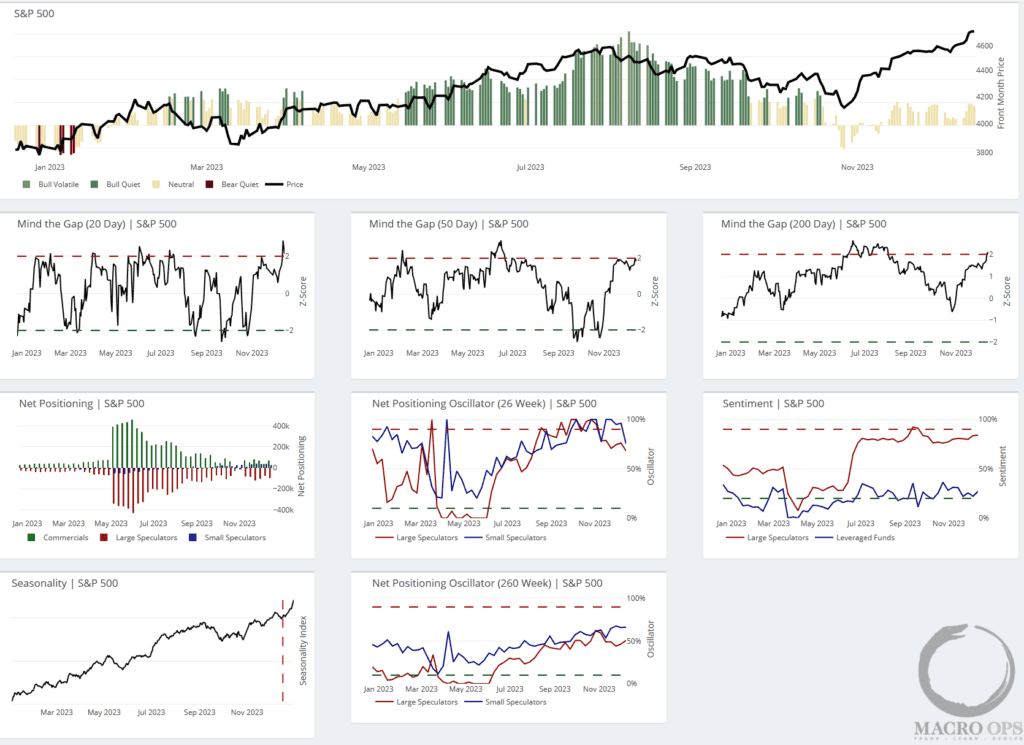

- Investor Optimism: The report notes a surge in bullish behavior among investors, particularly as the year-end approaches. However, it suggests that this optimism may be premature, given the current market conditions.

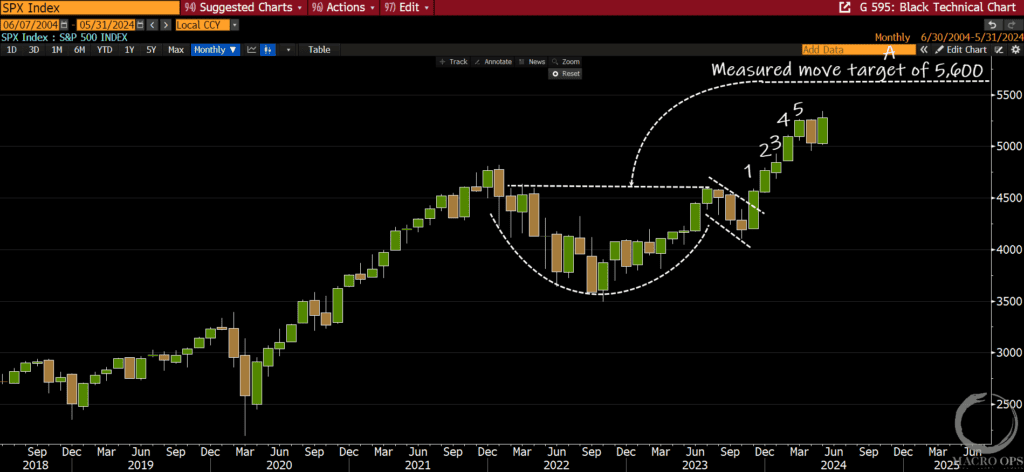

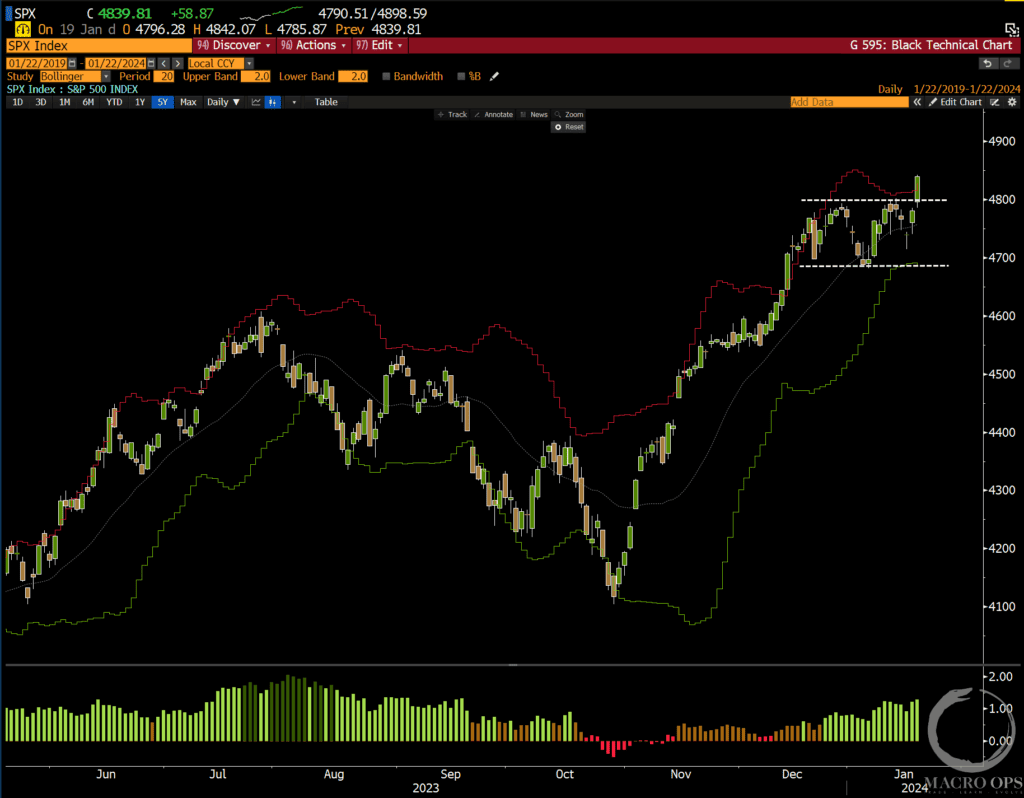

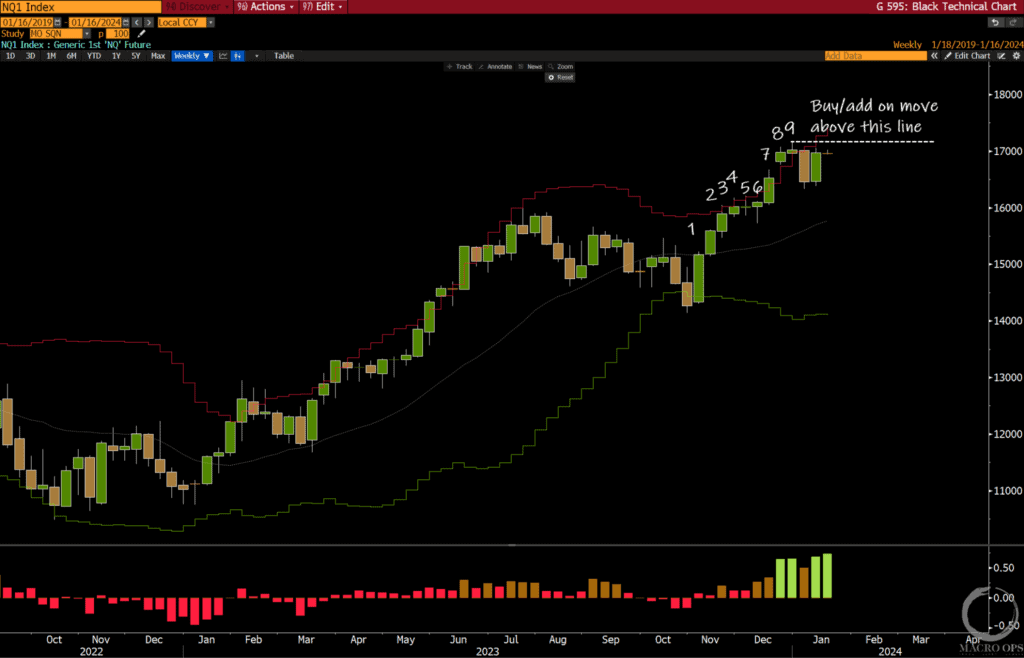

S&P 500 Volume Oscillator

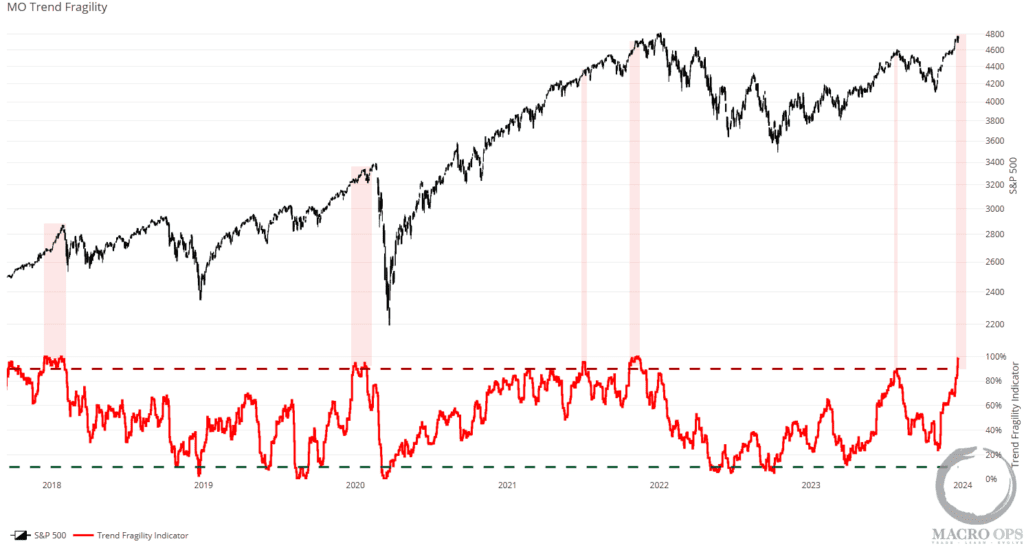

- Market Indicators: The S&P 500 volume oscillator, a key market indicator, is highlighted in the report. It suggests that while there have been bear market rallies from this level of oversold, there are no long-term buying opportunities at the current level.

Inflation and the Federal Reserve

- Monetary Policy: The report discusses the ongoing issue of inflation and the role of the Federal Reserve. It notes that despite repeated assurances from Fed members, including Powell, that inflation is under control, the market continues to front-run Fed easing.

Crypto Ponzi Schemes

- Crypto Risks: The report highlights the role of crypto Ponzi schemes in the market, suggesting that they are indicative of a fully lubricated risk appetite. However, it warns of the potential for fraud and deception on a large scale.

$USD/Yen Carry Trade

- Carry Trade Risks: The report discusses the risks associated with the $USD/Yen carry trade, particularly in light of the Bank of Japan’s removal of all easing and the Fed’s attempt to pause. It suggests that this is a significant risk that is being largely ignored by the market.

Actionable Insights

- Investor Caution: Given the current market conditions and the potential for a market crash, investors should exercise caution, particularly with regard to bullish behavior and the $USD/Yen carry trade.

- Monitor Market Indicators: Investors should closely monitor key market indicators, such as the S&P 500 volume oscillator, to inform their investment decisions.

- Consider Crypto Risks: Investors should be aware of the risks associated with crypto Ponzi schemes, including the potential for fraud and deception.