Research Summary

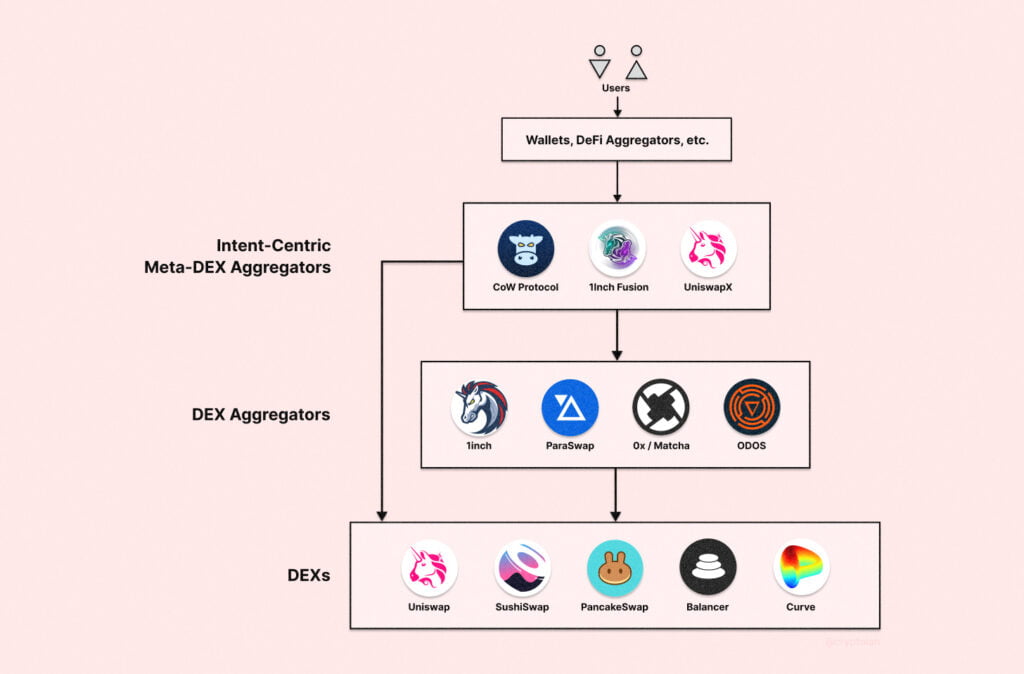

The report discusses the performance of 1inch Network, a decentralized finance (DeFi) service provider, in Q2 2023. The 1inch DAO voted to discontinue the collection of a swap surplus, citing inconsistency and negative impacts on users. Ethereum dominated volumes, making up over 70% of Q2’s total aggregation volume. The diversity of Fusion resolvers and total resolver volumes continue to increase, with over $11.7 billion in volume processed by resolvers in Q2. Development on 1inch Network’s Hardware Wallet continues, with 2 million USDC in funding to complete the product trade version.

Actionable Insights

- Monitor the impact of discontinuing the swap surplus: The decision to stop collecting the swap surplus could have significant implications for the 1inch DAO’s revenue streams. It’s essential to monitor how this change affects the platform’s financial health and user experience.

- Keep an eye on the development of the 1inch Network’s Hardware Wallet: With 2 million USDC in funding, the completion of this product could introduce new opportunities for users and potentially drive more volume to the platform.

- Observe the performance of Fusion resolvers: The increasing diversity and volume of Fusion resolvers indicate a growing interest in this feature. It’s worth tracking how this trend develops and how it impacts the overall volume on the platform.

- Watch for shifts in volume dominance: While Ethereum currently dominates volumes, changes in the crypto landscape could shift this dominance. Stay updated on trends and developments in other networks that could challenge Ethereum’s leading position.