Research Summary

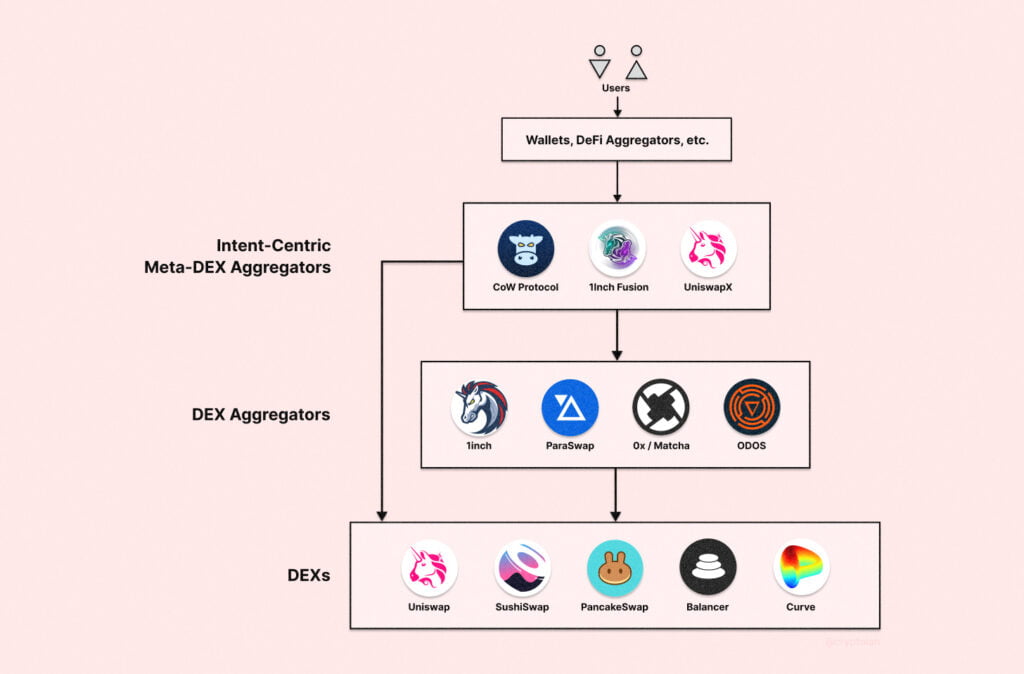

The report provides a comprehensive analysis of the 1inch Network, a decentralized finance (DeFi) service provider operating on multiple platforms. It covers the network’s performance, usage, treasury and staking analysis, and strategic outlook. The report also discusses the network’s key metrics, including daily active users, transaction volumes, and staking increases.

Key Takeaways

Performance and Usage Analysis

- Overall Performance: Despite a drop in transactions, volume, and daily active users (DAUs) in Q3, the report notes that transactions and DAUs have significantly increased over the past year. 1inch maintained a 50% volume market share among DEX aggregators, although the overall market shrunk by 20%.

- Usage Analysis: The report highlights that 1inch continued to attract strong usage, with daily average unique users falling to just under 40,000 in Q3. Over 50% of users were on 1inch’s largest two markets by DAUs, Polygon and BNB. The biggest decliners in terms of DAUs were Arbitrum and Avalanche, where usage declined 36% and 46% respectively.

- Volume Analysis: Trading volume on 1inch normalized after the USDC depeg in Q1, with volume falling in each protocol in Q3. The Limit Order Protocol volume fell 37% to $3.3 billion in volume, while volumes via 1inch Fusion fell 29% to $2.7 billion in the quarter.

- Transaction Analysis: Transaction and volume trends by chain were similar in Q3, with Arbitrum and Avalanche transaction counts falling 39% and 45%, respectively. However, activity did grow on Gnosis, Optimism, and Polygon.

- External Transactions: The number of external transactions, which represent transactions on 1inch that originate from proxy contracts or aggregators, increased by 15% in Q3. This gives a clear picture of the success and usage of 1inch integrations.

Treasury and Staking Analysis

- Treasury Analysis: The DAO turned off slippage revenue last quarter and also allocated $1 million USDC as a deposit on Aave to earn interest. The largest expense in Q3 was the Events Grant proposal that passed to fund 1inch at conferences and events with 1.94 million USDC.

- Staking Analysis: Turnover and staking flows were small in the quarter, with 12.6 million 1INCH staked and 2.4 million 1INCH unstaked. The 194 million 1INCH staked accounted for nearly 20% of the circulating supply.

Qualitative Analysis

- Strategy Outlook: The 1inch Network team and DAO has remained committed to its defense of its market share. They plan to turn the protocol into infrastructure and build a user-aligned business that drives value to the token.

- Building a Business: The accrual for the 1INCH token changed dramatically this year with the release of staking V2, the end of swap surplus revenue, and the release of the 1inch Fusion. Now, the primary value driver for 1INCH is likely staking and delegating to a resolver in exchange for earnings.

- Winning the Consumer: Since building a leading product in the aggregation protocol, 1inch is now in a position to create a best-in-class user experience that can further increase market share.

Actionable Insights

- Investigate the Potential: The report suggests that 1inch’s continued growth and dominance in the DeFi space make it a potential area of interest for stakeholders. Its strategic outlook, commitment to user-aligned business, and focus on creating a best-in-class user experience could drive further growth.

- Monitor Market Trends: The report highlights the importance of monitoring market trends, such as transaction volumes, daily active users, and staking flows, to understand the performance and potential of 1inch.

- Consider the Impact of Strategic Decisions: The report underscores the impact of strategic decisions, such as the release of staking V2 and the end of swap surplus revenue, on the value of the 1INCH token. Stakeholders should consider these factors when evaluating 1inch.