Research Summary

The report provides an in-depth analysis of 1inch’s performance in Q4’23, highlighting its significant growth in volumes and market share. It also discusses the network’s new products, the increase in 1INCH staking, and the DAO’s efforts to improve token accrual and resolver competition.

Key Takeaways

1inch’s Remarkable Growth in Q4’23

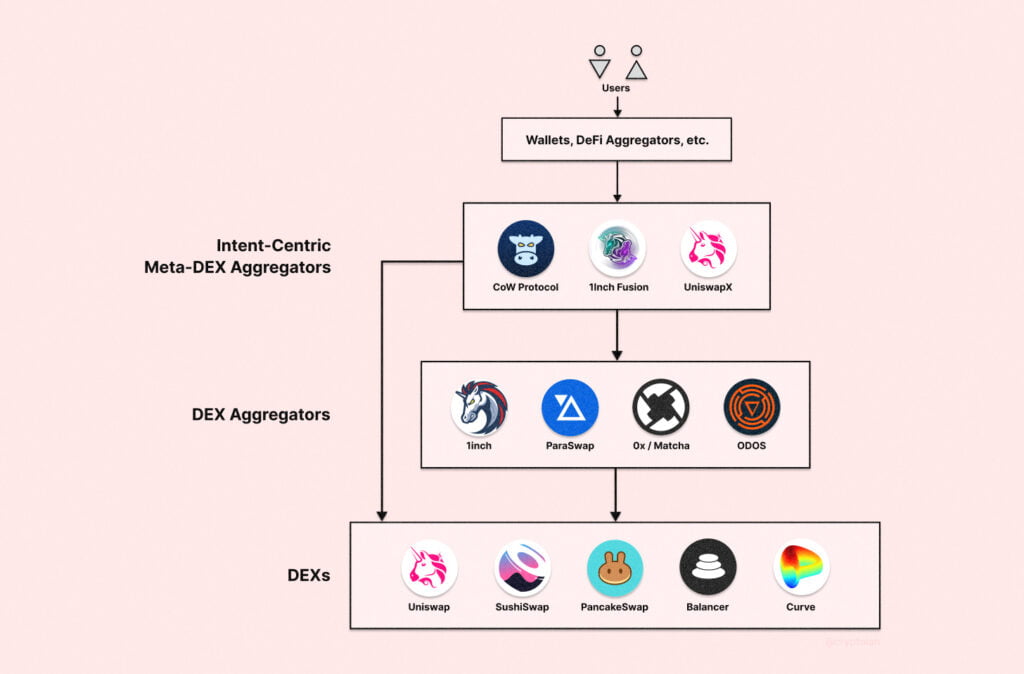

- Significant Increase in Volumes and Market Share: 1inch executed over $30 billion in volume in Q4’23, claiming 64% of the Ethereum DEX aggregator market share. This represents a substantial increase from the previous year, indicating the growing adoption of 1inch as a backend solution and the expansion of aggregators.

Performance of New Products

- Driving Transaction Growth: New products such as the Limit Order Protocol (LOP) and 1inch Fusion have been instrumental in driving transaction growth. Fusion transactions, in particular, rose by 66% in Q4’23, rebounding strongly after a 29% fall in the previous quarter.

Increased 1INCH Staking

- Boosting Token Accrual: The amount of 1INCH staked increased in Q4’23 as the DAO worked to improve token accrual through a fair and competitive market. This has created a valuable value accrual pathway for the token.

Resolver Competition and Market Design

- Efforts to Improve Resolver Competition: The DAO is focused on increasing competition for resolvers. In Q4’23, DAO members voted to set a cap for gas consumption for resolvers, which should enable resolvers to earn more and thus be able to pay more in rewards to stakers.

1inch’s Dominance in the Market

- Leading the DEX Aggregator Market: 1inch’s growth in volume was significantly higher than its peers in Q4’23, helping it increase its market share from 59% of trades in Q3’23 to 63% in Q4’23. This solidifies its position as the leading DEX aggregator on Ethereum.

Actionable Insights

- Monitor the Performance of New Products: Given the significant role of new products like the Limit Order Protocol (LOP) and 1inch Fusion in driving transaction growth, it would be beneficial to closely monitor their performance and user adoption rates.

- Assess the Impact of Increased 1INCH Staking: The increase in 1INCH staking could have significant implications for token accrual and the overall value of the token. Therefore, it’s crucial to assess the impact of this trend.

- Understand the Implications of DAO’s Efforts: The DAO’s efforts to improve resolver competition and market design could have far-reaching implications for the 1inch network. Understanding these implications could provide valuable insights into the network’s future trajectory.