Research Summary

The report discusses the current state of the market, highlighting key trends and indicators such as the S&P 500’s recent breakout, the flat year-on-year margin debt, the increase in put buying, the record low hedge fund exposure, and the positive and negative CAPEX cycle trends. It also mentions the deteriorating U.S. Treasury liquidity and the performance of two tech stocks, Palantir Technologies and Duolingo.

Key Takeaways

Market Trends and Indicators

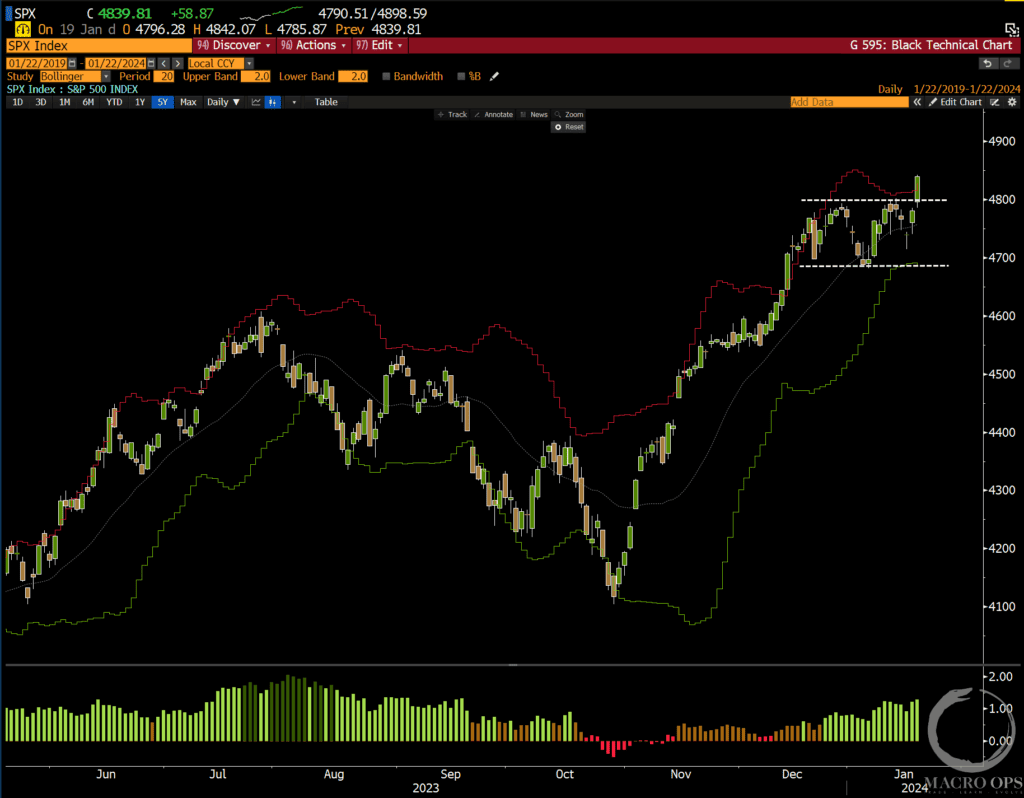

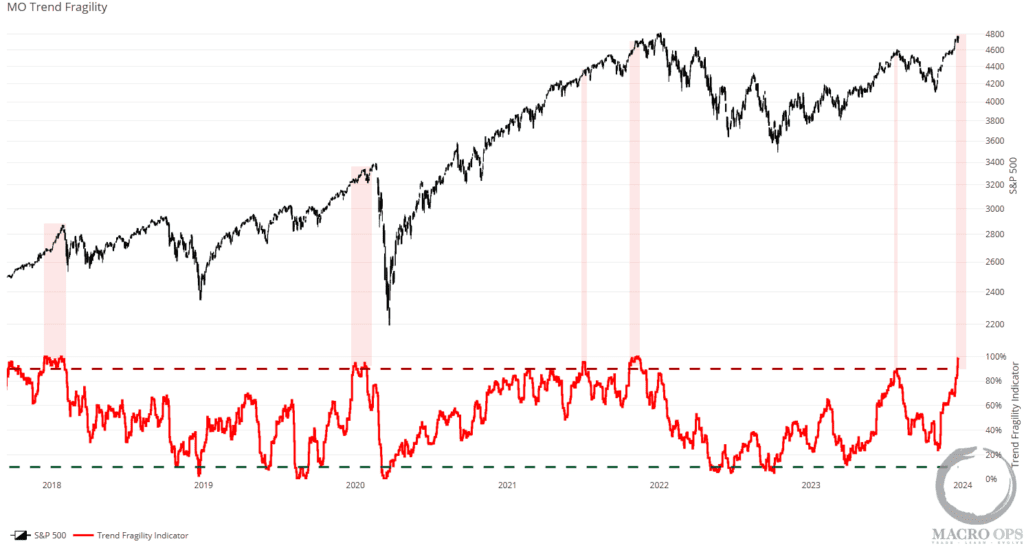

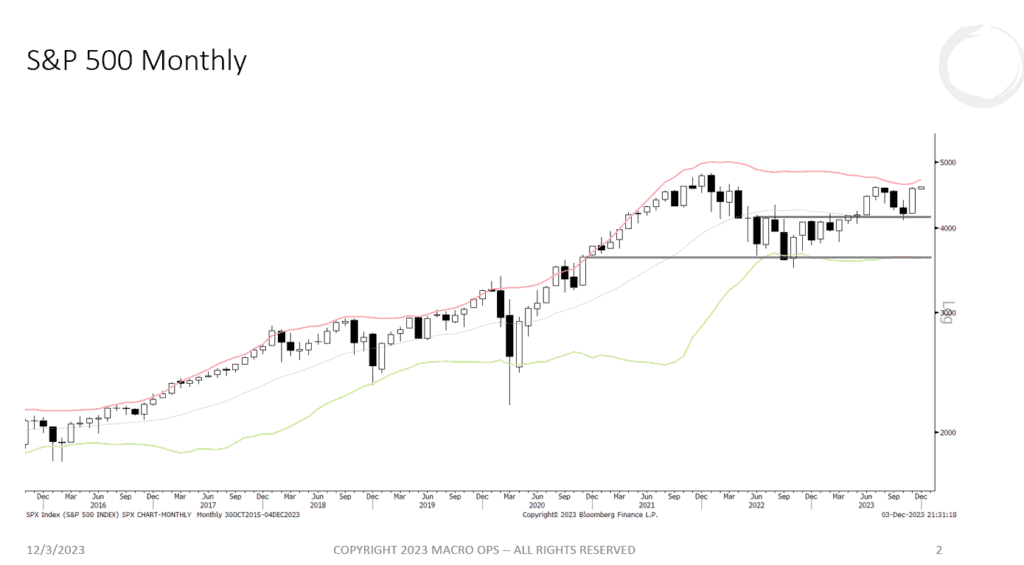

- S&P 500’s Breakout: The S&P 500 recently broke out from its monthly range and passed a significant test, strengthening the trend.

- Margin Debt: The year-on-year margin debt is currently flat, indicating that investors are not over-leveraging, which typically precedes cyclical bear markets.

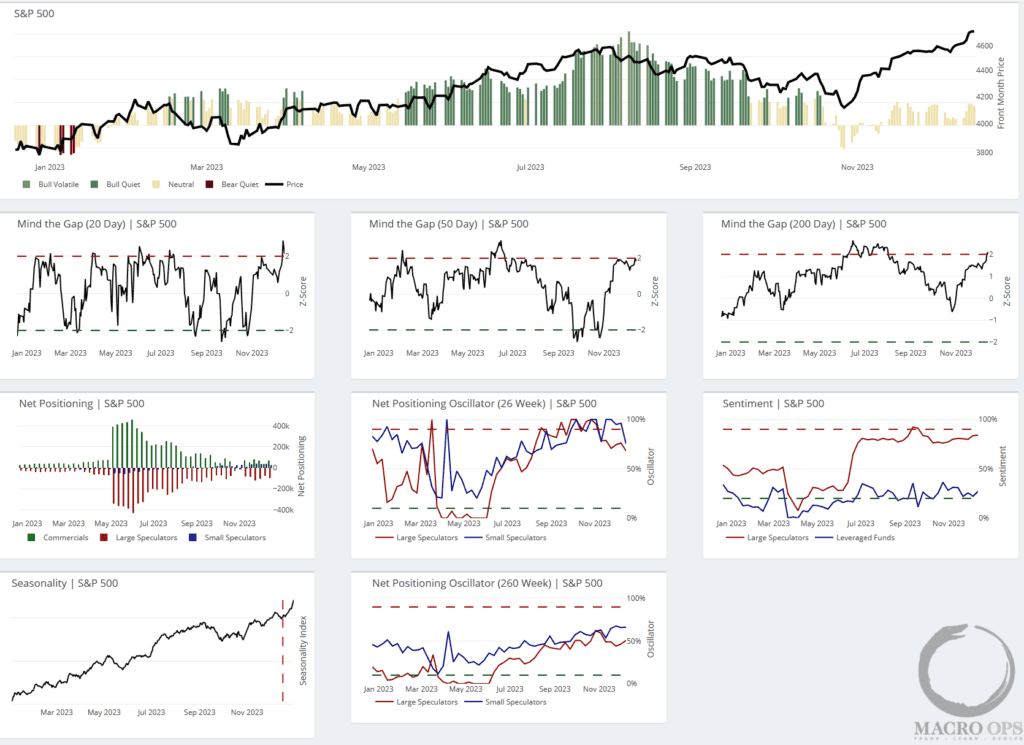

- Put Buying: There has been a surge in put buying, with equity options traders turning over more puts than calls over the past three sessions. This has only been exceeded twice in the past five years.

- Hedge Fund Exposure: Hedge fund exposure has fallen to its lowest levels ever, indicating a strong consensus among hedge funds.

- CAPEX Cycle Trends: While U.S. manufacturing construction spend is at multi-decade highs, Bloomberg’s Global CAPEX indicator is collapsing to levels that have preceded recessions in the past.

UST Liquidity and Tech Stocks

- UST Liquidity: The U.S. Treasury liquidity index is worsening and is now at its worst level since 2011. This is concerning as the recent 30-year auction saw the worst tail since August 2011.

- Palantir Technologies: Palantir Technologies is one of the two tech stocks highlighted in the report for its strong long-term charts and recent relative performance.

- Duolingo: Duolingo is the other tech stock highlighted in the report for its strong long-term charts and recent relative performance.

Actionable Insights

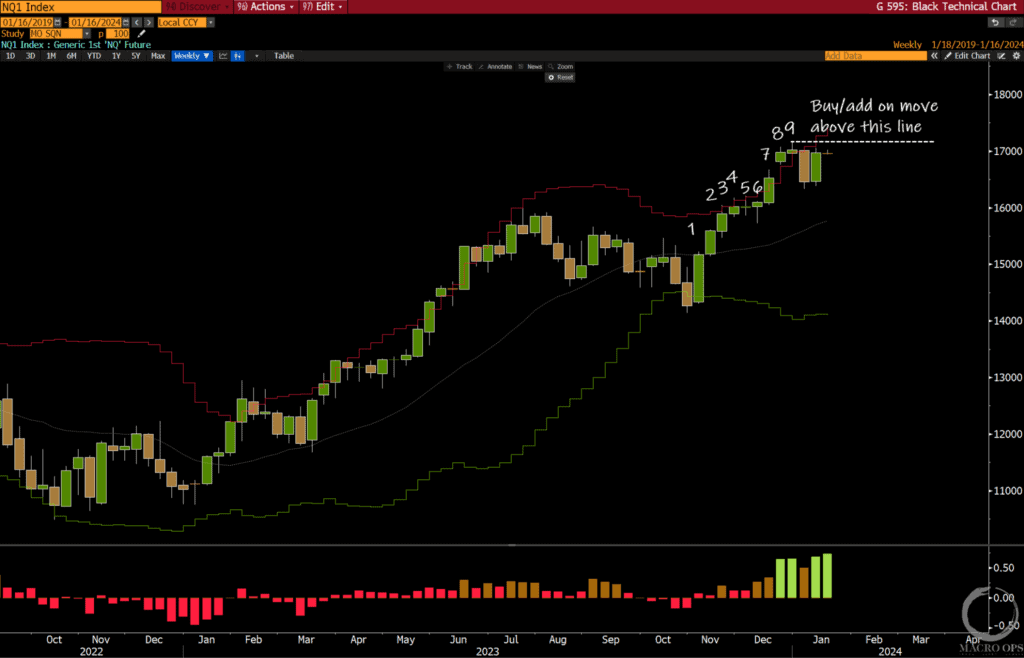

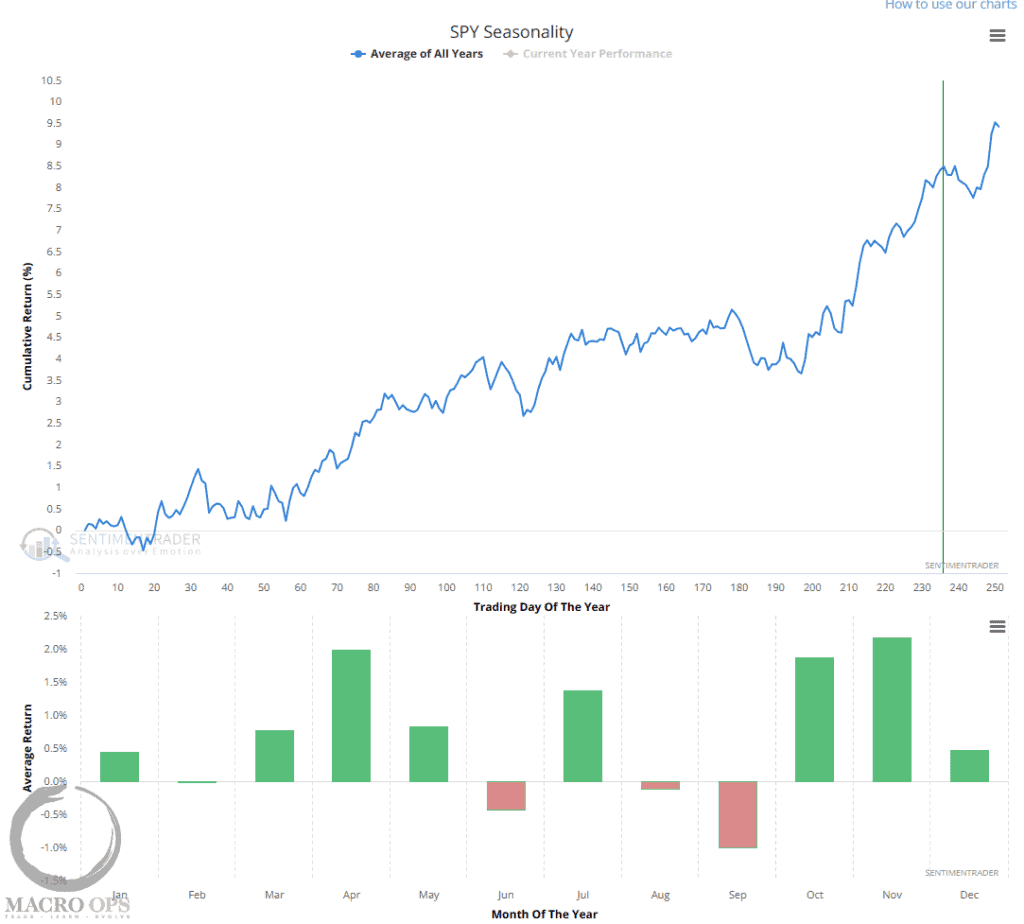

- Market Positioning: Given the current backdrop of negative sentiment and positioning, along with the recent cluster of breadth thrusts and positive seasonality, it may be beneficial to maintain a long position in the market.

- Investigate the Potential of Tech Stocks: The strong long-term charts and recent relative performance of Palantir Technologies and Duolingo suggest that these tech stocks may be worth investigating further.